Bitcoin in October: $33B in LTH Selling vs $3.4B in ETF Inflows

In Brief

- Long-term Bitcoin holders sold 300K BTC in October, signaling major profit-taking activity.

- Bitcoin ETFs gained $3.4B in net inflows, led by BlackRock’s $3.93B institutional exposure.

- Price closed October above key technical levels, echoing 2020–2022 breakout patterns.

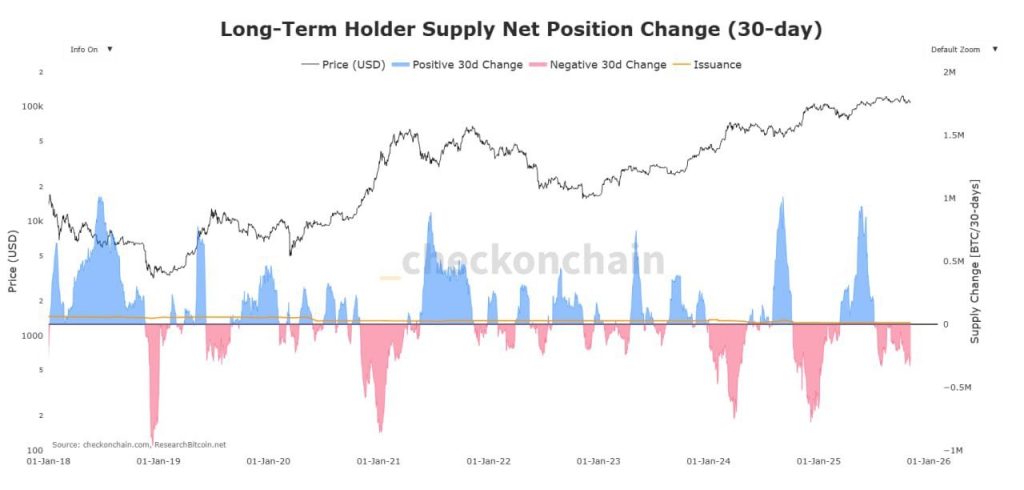

Long-term Bitcoin holders offloaded approximately 300,000 BTC in October, worth around $33 billion, according to Checkonchain. This marked the largest monthly selling wave since December 2024, signalling broad profit-taking after sustained accumulation.

The 30-day net position change dropped sharply, suggesting heavy distribution as prices approached key resistance zones above $100,000. Historically, such phases have occurred after strong rallies, often leading to short-term corrections or consolidation.

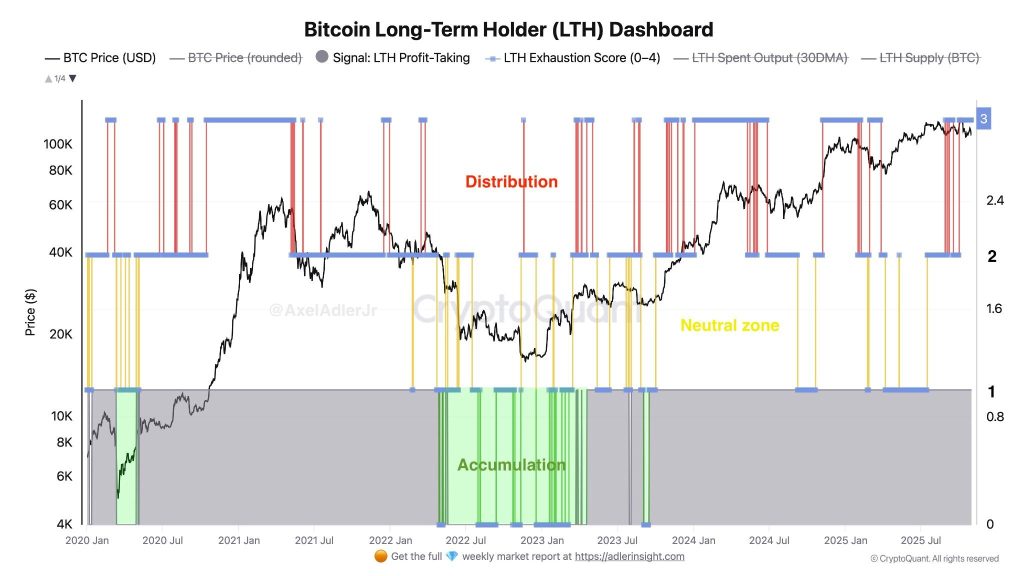

CryptoQuant data also shows sustained selling activity in the $90,000–$100,000 range, confirmed by an elevated LTH Exhaustion Score near 3. This metric indicates continued pressure from older holders, which may limit upside momentum until the score cools to accumulation levels.

While newer buyers absorb supply, volatility remains high as Bitcoin attempts to stabilise. Price action may stay range-bound until long-term holders slow their selling activity or shift back into accumulation mode.

ETF Inflows Signal Institutional Strength as Price Mirrors Past Cycles

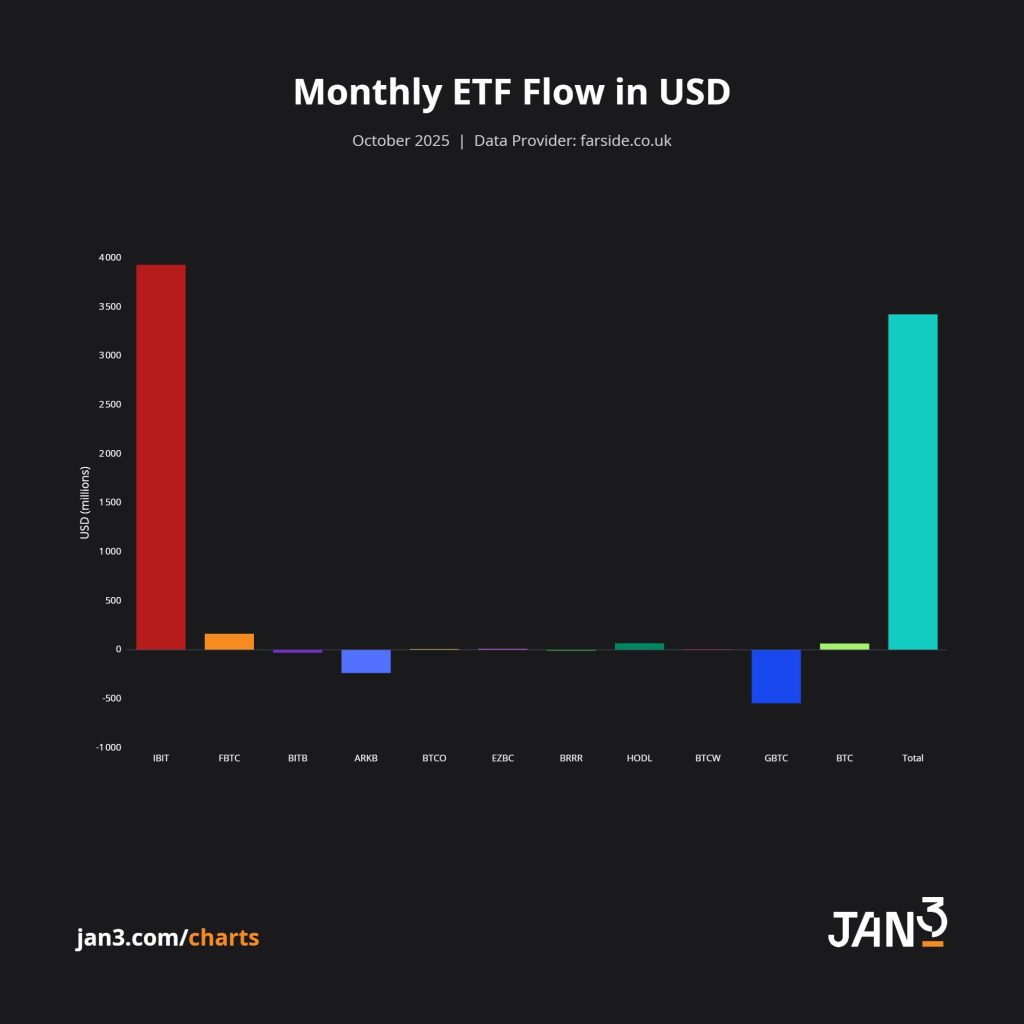

Despite increased selling by long-term holders, Bitcoin ETFs recorded $3.42 billion in net inflows during October, according to farside. BlackRock’s IBIT led with $3.93 billion in inflows, while GBTC and ARKB faced outflows amid ETF rotations.

This reflects strong institutional demand and growing confidence in regulated Bitcoin exposure, even as market conditions remain volatile. Fidelity’s FBTC also recorded modest gains, supporting the broader inflow trend into newer spot ETF offerings.

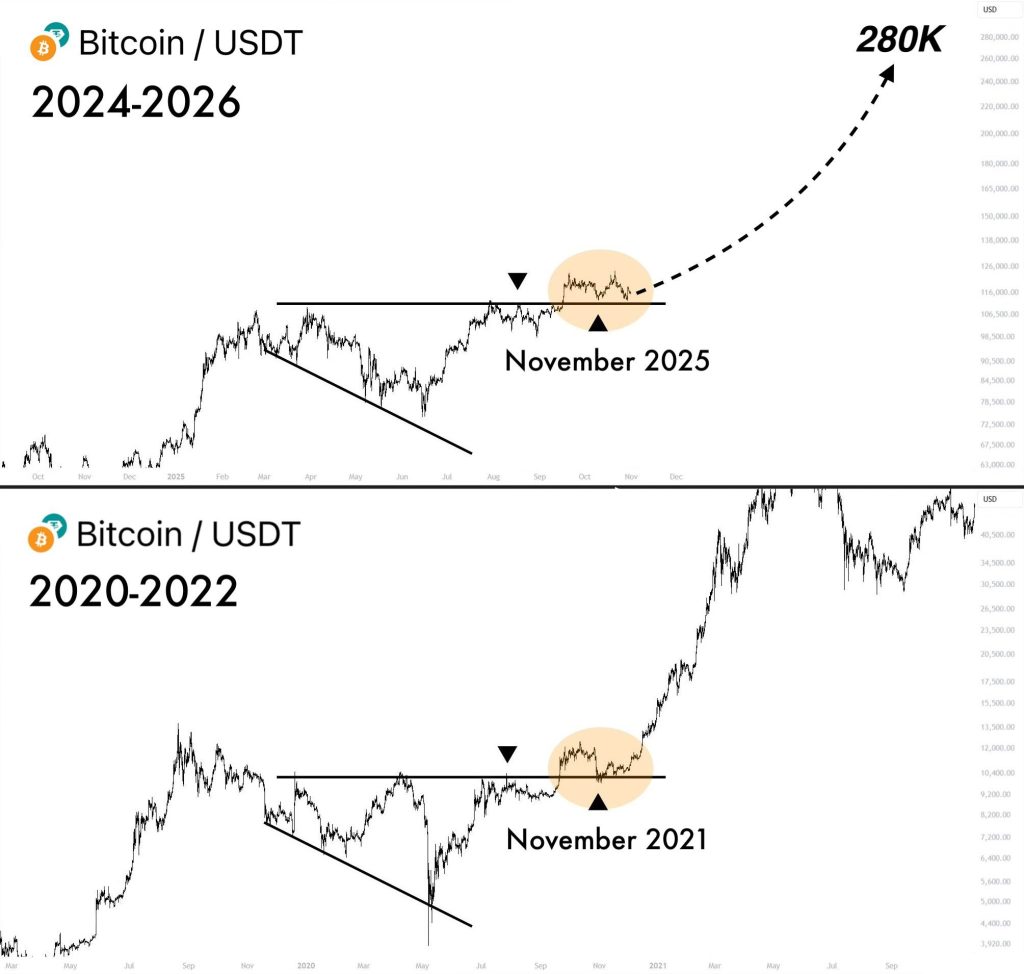

Meanwhile, analyst QuintenFrancois notes that Bitcoin’s current structure mirrors the 2020–2022 cycle, especially after a major liquidation event. The October close above the 5 EMA, 10 SMA, and Q1 high suggests technical strength and potential for upward continuation.

Price consolidation near $115,000 resembles mid-cycle accumulation patterns from previous bull markets. If the current fractal holds, Bitcoin could enter a parabolic phase with targets as high as $280,000.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |