- Powell maintains neutrality on Bitcoin prices.

- Inflation tied to supply and demand dynamics.

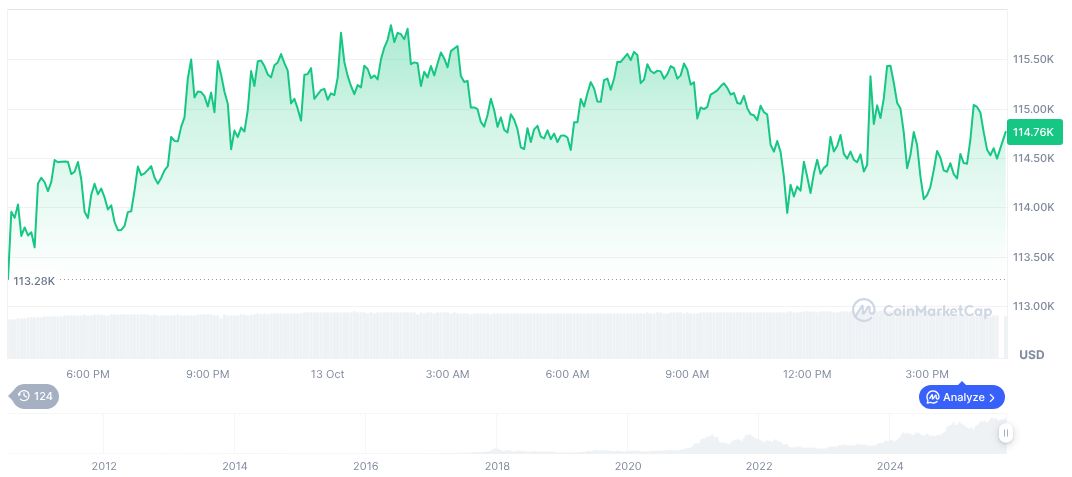

- Limited Bitcoin market volatility following Powell’s comments.

Federal Reserve Chairman Jerome Powell declined to comment on Bitcoin and gold prices during a recent discussion, focusing instead on inflation driven by supply-demand dynamics.

Powell’s stance highlights the Federal Reserve’s commitment to economic fundamentals, influencing market stability but leaving Bitcoin volatility largely unaffected.

Cryptocurrency Market Stability Amid Powell’s Neutral Stance

Without official comments directly affecting Bitcoin, market reactions were subdued. Bitcoin and other cryptocurrencies often fluctuate due to general monetary policies and global events, not specific statements unless they indicate policy shifts. Notably, the crypto market saw little volatility directly attributable to Powell’s recent speech. In previous instances, similar speeches did not trigger any major directional movements as long as key policy changes were unannounced.

According to CoinMarketCap, Bitcoin currently trades at $112,682.23. It holds a market cap of $2.25 trillion, capturing a dominance of 58.34%. The trading volume in the past 24 hours reached $84.96 billion, experiencing a slight dip. Recent price movements saw declines of -7.56% over the last week and -1.75% in the past day, while the circulating supply stands at 19.93 million out of a max 21 million.

“Inflation is primarily influenced by fundamental supply and demand factors.” — Jerome Powell

Market Insights Post-Powell’s Comments

Did you know? In historical cases, the Federal Reserve’s neutral stance on asset prices often results in short-term period volatility rather than sustained price direction for cryptocurrencies.

According to Coincu’s research team, cryptocurrency market trends illustrate volatility influenced by general macroeconomic sentiments rather than isolated policy comments. Bitcoin remains reactive but stable relative to fundamental economic nuances such as interest rates or monetary policies, rather than speculative punt remarks about individual asset prices.

Market analysts suggest that the current environment requires investors to focus on macroeconomic indicators rather than individual asset performance, especially in light of Powell’s recent comments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |