- Jack Kong predicts Bitcoin price at $98,200 in 2024.

- 400,000-time increase since Bitcoin’s inception.

- Bear market bottoms historically occur around Christmas.

Jack Kong of Nano Labs tweeted an analysis on Bitcoin’s historical price pattern over Christmas, correlating a significant rise from $0.25 in 2010 to $98,200 in 2024.

This trend indicates potential for Christmas-time Bitcoin market bottoms, suggesting a cyclical adjustment in 2025. The analysis underscores Bitcoin’s volatile nature as a developing value store.

Jack Kong Predicts Bitcoin Surge to $98,200 by 2024

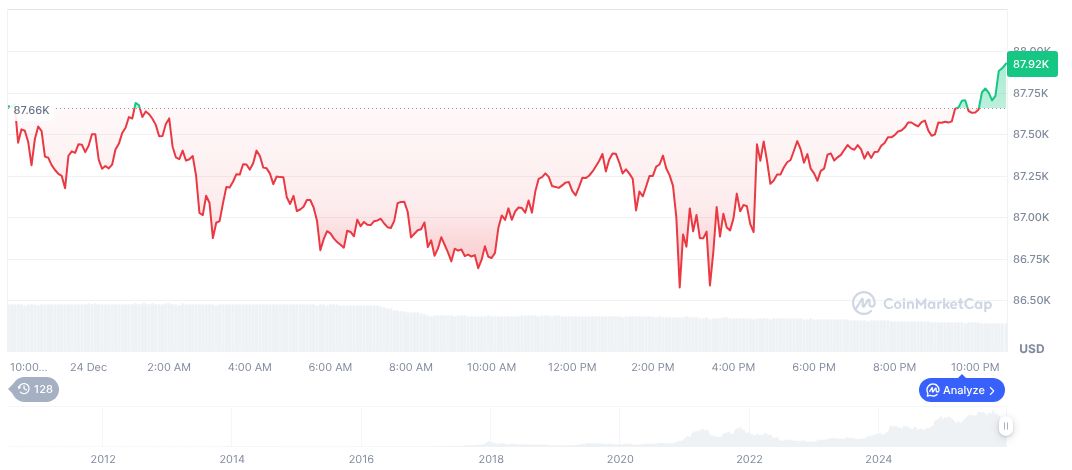

Jack Kong, Founder and CEO, Nano Labs, projected “a cyclical pullback from 2024’s ~$98,200 to $88,000 for 2025,” reflecting on historical BTC bear market bottoms around Christmas.

Ethan Vera, COO of Luxor Technology, commented that miners are underclocking machines to save on energy during pressure from the current hash pricing. The Xinjiang mining shutdowns reduced the overall Bitcoin network hashrate by 8%, emphasizing the dynamic and reactive nature of Bitcoin mining activities.

Jack Kong, Founder and CEO, Nano Labs, projected “a cyclical pullback from 2024’s ~$98,200 to $88,000 for 2025,” reflecting on historical BTC bear market bottoms around Christmas.

Historical Trends Support Future Bitcoin Projections

Did you know? Jack Kong’s analysis highlights that historical Bitcoin bear market bottoms, including $16,831 in 2022, could imply consistent cyclic occurrences around Christmas, providing context to his 2024 projection.

As of December 25, 2025, Bitcoin (BTC)’s current price is $87,748.74, with a market cap of $1.75 trillion, according to CoinMarketCap. The cryptocurrency commands a 59.14% dominance, and recent data shows a 0.19% rise in 24-hour price changes. Despite a 22.64% decline over 60 days, the market remains substantial.

Coincu research suggests that emerging trends, such as China’s ongoing regulatory stance on cryptocurrency mining, could lead to more temporary disruptions rather than long-term impacts on Bitcoin pricing. Historical trends indicate that price bottoms could occur cyclically, lending further context to current market behaviors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |