- Michael Saylor posts cryptic message suggesting Bitcoin purchase.

- Historically, such messages precede new BTC holdings announcement.

- Saylor’s post may affect Bitcoin and MicroStrategy stock.

Michael Saylor, MicroStrategy’s founder, cryptically posted ‘Orange or green?’ on X, hinting at another potential Bitcoin acquisition, a pattern preceding their official announcements.

This signaled market anticipation as prior messages like this prefaced MicroStrategy’s Bitcoin purchases, impacting both Bitcoin prices and MicroStrategy’s stock value.

Saylor’s Cryptic Posts and Market Reactions

Michael Saylor, Executive Chairman of MicroStrategy, released a teaser post on X, stating “Orange or green?” Historically this has indicated an impending announcement of Bitcoin acquisition by MicroStrategy.

Such announcements typically occur the day after these cryptic messages are posted.

“Persistent, high‑conviction accumulation independent of short‑term volatility.” — Michael Saylor

MicroStrategy’s Bitcoin Strategy and Market Data

Did you know? Michael Saylor’s cryptic posts have previously led to significant speculative activity, impacting the Bitcoin price temporarily prior to formal disclosures.

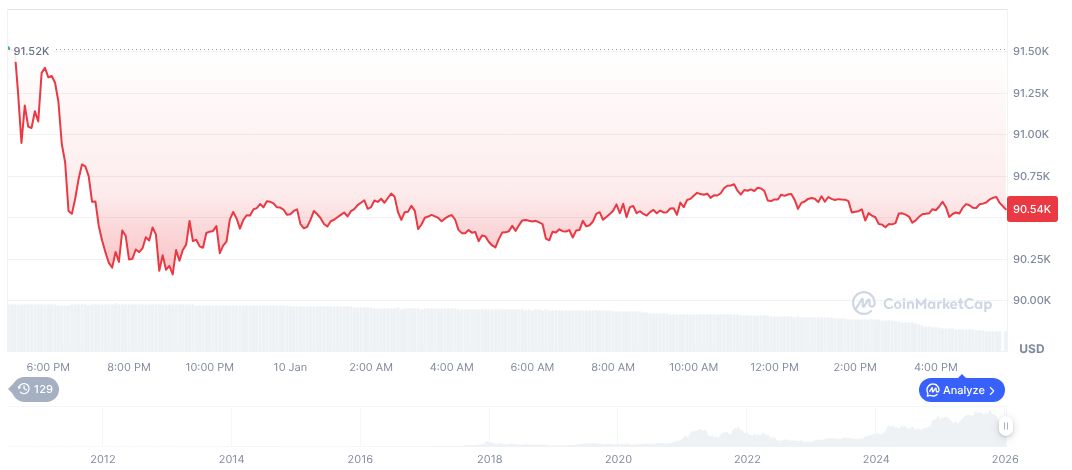

As of January 11, 2026, Bitcoin (BTC) is trading at $90,936.34 with a market cap of $1.82 trillion, according to CoinMarketCap. Prices saw a slight increase of 0.47% in 24 hours, despite a -20.62% drop over 90 days, while maintaining a dominant market share of 58.41%.

Insights from Saylor on current cryptocurrency developments indicate that MicroStrategy’s Bitcoin-focused strategy has consistently impacted market sentiment. The possibility of further Bitcoin accumulation by Saylor’s company may catalyze long-term price support for Bitcoin. While regulatory pressures remain, these accumulations emphasize the enduring institutional interest in Bitcoin, supporting its perception as a digital asset of substantial value.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |