- Strategy Inc. reports a $17.44 billion unrealized Bitcoin loss in Q4.

- Stock price has decreased 70% from its 2024 peak.

- Investor confidence wanes as share sales build cash reserves.

Panews reported on January 5th, 2026, that Strategy Inc., led by Michael Saylor, disclosed a fourth-quarter unrealized loss of $17.44 billion due to declining Bitcoin values.

The significant loss underscores ongoing concerns about Strategy Inc.’s heavy reliance on Bitcoin amid a 70% drop in stock value since its 2024 peak.

Historical Context and Bitcoin Market Trends

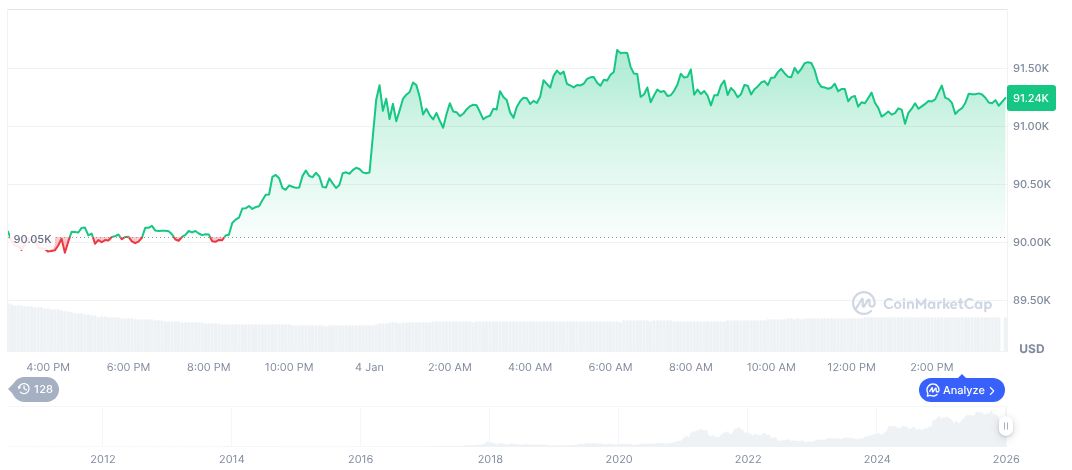

CoinMarketCap reveals Bitcoin (BTC) is currently valued at $92,580.72 with a market cap of $1.85 trillion. Bitcoin holds a 58.84% market dominance. Recent price changes within the last 24 hours show a rise of 1.52%, though over 90 days, prices show a decline of 25.13%.

According to research from Coincu, regulatory scrutiny and market dynamics may pressure Strategy Inc. to reconsider its Bitcoin strategy. Historical data suggests potential regulatory impacts could further affect their corporate model.

“Since 2020, I have driven Strategy’s Bitcoin holdings—now over 649,870 to 671,000 BTC—positioning it as the largest corporate holder via equity/debt issuance.” — Michael J. Saylor

Market Data and Future Implications

Did you know? In 2000, Strategy Inc., then known as MicroStrategy, faced SEC charges for fraudulent reporting. Today, the unrealized losses shine a spotlight on similar financial strains, albeit through a Bitcoin-focused lens.

CoinMarketCap reveals Bitcoin (BTC) is currently valued at $92,580.72 with a market cap of $1.85 trillion. Bitcoin holds a 58.84% market dominance.

Recent price changes within the last 24 hours show a rise of 1.52%, though over 90 days, prices show a decline of 25.13%.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |