Key Insights:

- BlackRock increased its BMNR stake by 165.6% to over nine million shares.

- BMNR gained nearly 2% despite broader crypto market weakness and volatility.

- BitMine continues Ethereum purchases and cites MrBeast link for future growth plans.

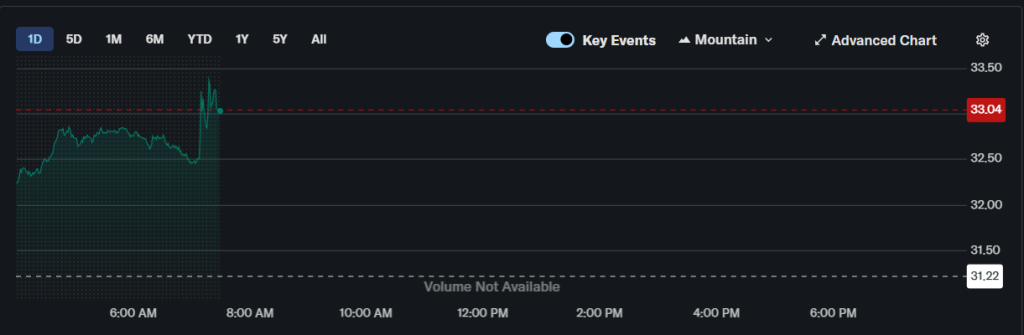

BMNR shares moved higher after BlackRock disclosed a sharp increase in its position in BitMine Immersion Technologies. The stock gained nearly 2% in recent trading, even as the wider crypto market remained under pressure.

A recent 13F filing showed that BlackRock raised its stake in BitMine by 165.6% during the quarter. The firm reported ownership of 9,049,912 shares valued at about $245.7 million as of December 31, 2025. In its prior filing, BlackRock held 3,407,322 shares.

BMNR Rises Despite Crypto Market Decline

Crypto prices have faced steady selling in recent weeks. BMNR stock, however, recorded a modest rebound following the filing. Trading data from Yahoo Finance showed the shares edging higher after the disclosure became public.

BitMine operates as an Ethereum treasury-focused company. The firm has continued to acquire ETH during the market downturn. Earlier this week, it purchased about $84 million worth of Ethereum. The company also stakes the tokens as part of its treasury activity.

Tom Lee addressed the company’s strategy during a recent interview. He said, “You should be thinking about opportunities here instead of selling.” He also linked recent crypto weakness to sharp swings in gold prices at the end of January.

BlackRock Expands Position in BitMine

The updated filing reflects a large increase in BlackRock’s exposure to BMNR. The move came even as BitMine reported an unrealized loss of roughly $8 billion tied to market conditions.

Institutional filings often draw attention from traders seeking insight into fund positioning. BlackRock’s higher share count places it among the larger reported holders of BMNR based on the latest data.

BitMine Points to MrBeast Connection

BitMine has also referenced its reported association with content creator MrBeast as part of its broader business plans. Company representatives have said younger audiences may engage with digital finance platforms over time.

Lee stated, “Beast has an opportunity to become the financial institution of its generation.” He added that Gen Z and Gen Alpha are expected to take part in a future wealth transfer cycle.

BMNR stock remains about 10% lower for the month, despite the recent price uptick. Investors continue to watch institutional filings and company updates as the crypto market adjusts to ongoing volatility.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.