- Preliminary conditional approval attained for operations focused on crypto and AI.

- Emphasizes filling the service void post-SVB collapse with a $275M backing.

- Promotes stablecoin adoption for high-net-worth individuals and institutional investors.

On October 15, Erebor received preliminary, conditional approval from US regulators to launch a new crypto-focused bank in Columbus, Ohio, co-founded by Palmer Luckey and Joe Lonsdale.

This approval marks a significant shift in crypto banking, potentially easing institutional entry amid gaps left by recent bank collapses. Erebor will focus heavily on stablecoin services.

Stablecoins and Regulatory Dynamics Shape Erebor’s Banking Model

Erebor Bank, spearheaded by prominent tech figures Palmer Luckey and Joe Lonsdale, aims to bridge the banking service void, emphasizing the crypto, AI, and defense sectors. The bank is notably positioning itself as a digital services innovator with a focus on stablecoins.

The bank seeks to transform crypto-servicing by integrating stablecoins into its offerings, intended to support high-net-worth clients and institutional investors. This, alongside its potential as a narrow banking model, highlights its role in safe digital asset management.

Market stakeholders are observing the move closely. Senator Elizabeth Warren cautioned about potential favoritism, while Peter Thiel’s backing signifies strong influence. Public confirmations are limited as primary figures’ statements remain absent on social media platforms.

Market Data and Predictions

Did you know? The collapse of SVB left a substantial service void among tech firms, which Erebor aims to fill, drawing parallels with Anchorage Digital’s 2021 pivotal charter for crypto banking integration.

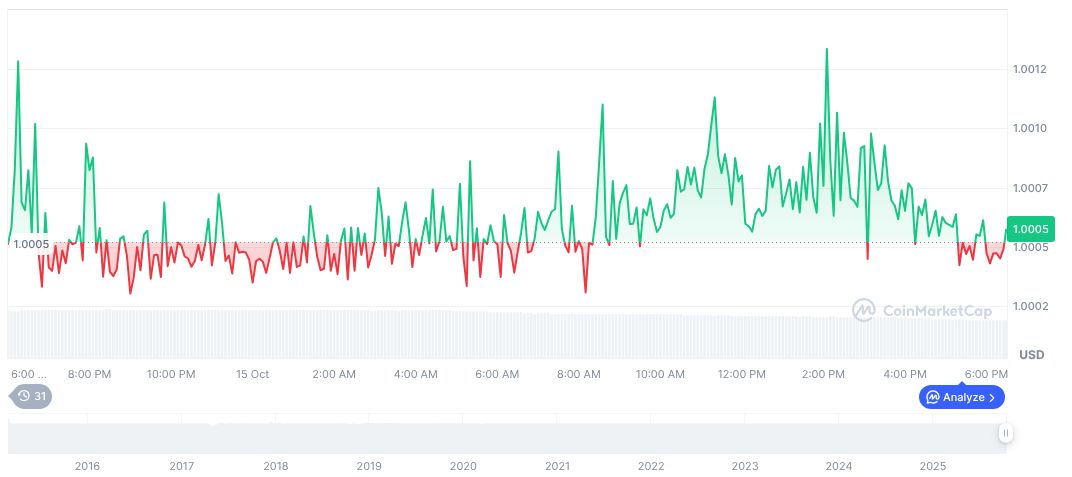

Tether USDt (USDT) maintains a steady value at $1.00, with a current market cap of $180.70 billion and a dominance of 4.79%. Trading volume has seen a decrease of 19.7% in the past 24 hours, as reported by CoinMarketCap.

Coincu researchers predict Erebor’s strategy could instigate institutional adoption of stablecoins, expanding the U.S. crypto banking landscape. Erebor’s conservative full-reserve model may set a precedent for regulated digital banking, potentially catalyzing broader market acceptance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |