- Tempo raises $500 million in Series A round led by Greenoaks.

- Valuation reaches $5 billion, high for blockchain ventures.

- Focus on payments, aiming to disrupt global finance.

Tempo, co-developed by Stripe and Paradigm, secured a $500 million Series A funding on October 18, 2023, marking a significant blockchain venture backed by Greenoaks and Thrive Capital.

Tempo aims to transform global payments with its Layer 1 blockchain for stablecoins, potentially challenging established networks and crypto incumbents.

Tempo’s $5B Valuation: A New Era in Blockchain Funding

Tempo, co-founded by fintech giant Stripe and venture firm Paradigm, has successfully secured a $500 million Series A funding round. This financing ranks among the highest for blockchain ventures, valued at $5 billion, with Greenoaks and Thrive Capital leading the round. Involving other notable investors, Sequoia Capital, Ribbit Capital, and SV Angel participated, though Stripe and Paradigm did not contribute financially, ensuring Tempo’s autonomy.

Aiming to revolutionize payments, Tempo focuses on stablecoin transactions, challenging current incumbents like Circle and Tether. Investors are optimistic about its enterprise applications, as demonstrated by its high valuation and the array of design partners involved, including OpenAI, Shopify, and Visa.

**Matt Huang, Co-founder, Paradigm** – “Tempo is purpose-built for stablecoins and real-world payments, born from Stripe’s experience in global payments and Paradigm’s expertise in crypto tech…”

Investor reactions appear positive, drawing attention from mainstream market participants seeking strategic financial exposure. While public figures and crypto experts have made no direct statements on Tempo’s funding, Stripe’s underlying involvement has signaled confidence in the project’s approach and potential impact on the existing payment ecosystem.

Stablecoin Innovations: Tempo’s Impact on Global Transactions

Did you know? Tempo’s valuation of $5 billion is one of the highest seen in recent blockchain venture rounds, indicating a growing trend among traditional investors for exposure to blockchain-based financial systems.

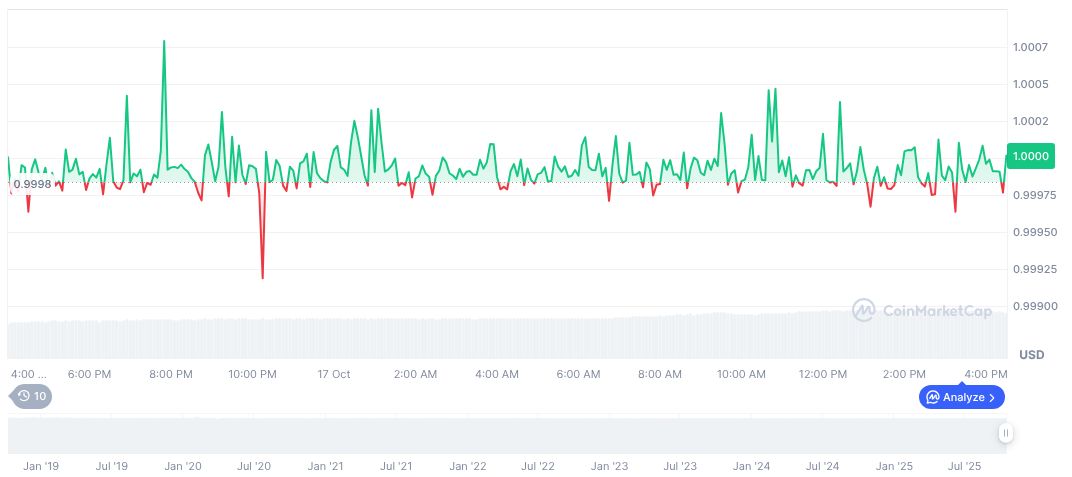

According to CoinMarketCap, USDC maintains a steady value at $1, with a market cap of $75.96 billion. Despite a 1.69% drop in the last 24 hours, its dominance remains at 2.10%, showcasing its continued significance in crypto markets as a preferred stablecoin.

The Coincu research team anticipates long-term shifts in financial infrastructure due to Tempo’s focus on stablecoins. Given its strong institutional backing and potential regulatory support, Tempo could redefine transaction methods within and beyond the crypto industry, providing a payment-optimized blockchain solution.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |