Visa Tests Stablecoin Payments for Faster Cross-Border Transactions

- Visa tests stablecoin payments to expedite cross-border transactions.

- Reduces settlement time from days to minutes.

- USDC and EURC are initial stablecoins in pilot.

Visa has initiated a pilot allowing businesses to use Circle’s USDC and EURC for cross-border payments through its Visa Direct platform, significantly reducing settlement time from 2026 onwards.

This pilot signifies Visa’s move to leverage blockchain for faster global remittances, potentially reshaping liquidity access for businesses while possibly increasing on-chain activities for USDC and EURC.

Visa’s SIBOS 2025 Announcement: A New Era for Cross-Border Payments

Visa has introduced a pilot project leveraging stablecoins USDC and EURC for cross-border payments. This initiative, revealed at the SIBOS 2025 conference, allows businesses to pre-fund transactions with stablecoins through the Visa Direct platform, bypassing traditional fiat currency hurdles. By treating these stablecoins as “bank deposits,” Visa simplifies remittances by reducing the need to lock in large cash amounts. This reduces the settlement time from several days to mere minutes, thus enhancing cash flow. Market participants have shown interest due to the potential for faster settlement and liquidity improvements. As the pilot progresses, more stablecoins may be included to expand service options.

Official partners have not been disclosed, although USDC and EURC are confirmed as initial stablecoins in use.

“Visa Direct now enables businesses to pre-fund with stablecoins, unlocking faster access to liquidity and more flexible cross-border payouts.” — Visa Inc.

Stablecoin Utilization: Market Perspectives and Historical Context

Did you know? Visa previously experimented with stablecoin settlement with Crypto.com in 2021 but this marks its first business-focused cross-border pilot utilizing blockchain.

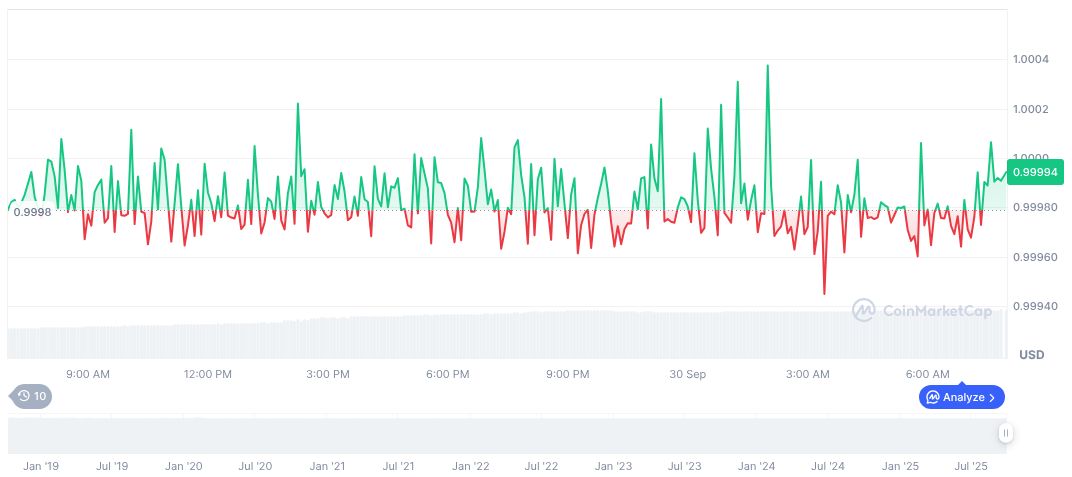

USDC continues to hold its value at $1.00, with a market cap of 73.56 billion and is ranked with a 1.90% market dominance. CoinMarketCap data from September 30, 2025, shows a 24-hour trading volume of 15.60 billion, displaying a volatility of 8.52%. Price changes were minimal over the past 90 days.

Insights gathered by the Coincu research team suggest that Visa’s pilot could set a precedent for faster cross-border transactions and regulatory adoption. Long-term, this might streamline global commerce and add robustness to the underlying blockchains supporting stablecoins. Learn more about the potential impact on the digital asset treasury 2023.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |