Bitcoin’s Move to $96K Was No Surprise—Here’s What On-Chain Data Showed?

In Brief

- Spot Taker CVD turned positive near $86K, signaling early, sustained buy pressure

- Whale-sized spot orders dominated accumulation before futures momentum kicked in

- Falling USDT dominance confirmed liquidity rotation into BTC and broader risk assets

Bitcoin’s recent rally from $84.4K to $96K didn’t emerge out of nowhere. On-chain indicators from CryptoQuant were already flashing green well before price acceleration became obvious.

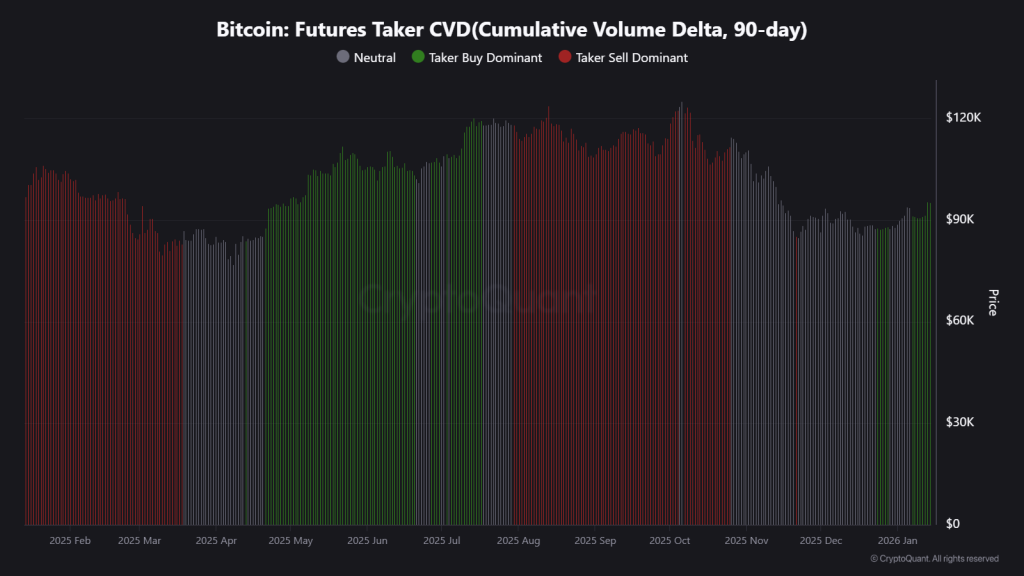

The first signal came from Spot Taker CVD (90-day), which began turning positive around $86K. This marked a clear shift into Taker Buy dominance, meaning aggressive market buy orders consistently outweighed sell pressure. In short, real spot demand was building quietly beneath the surface.

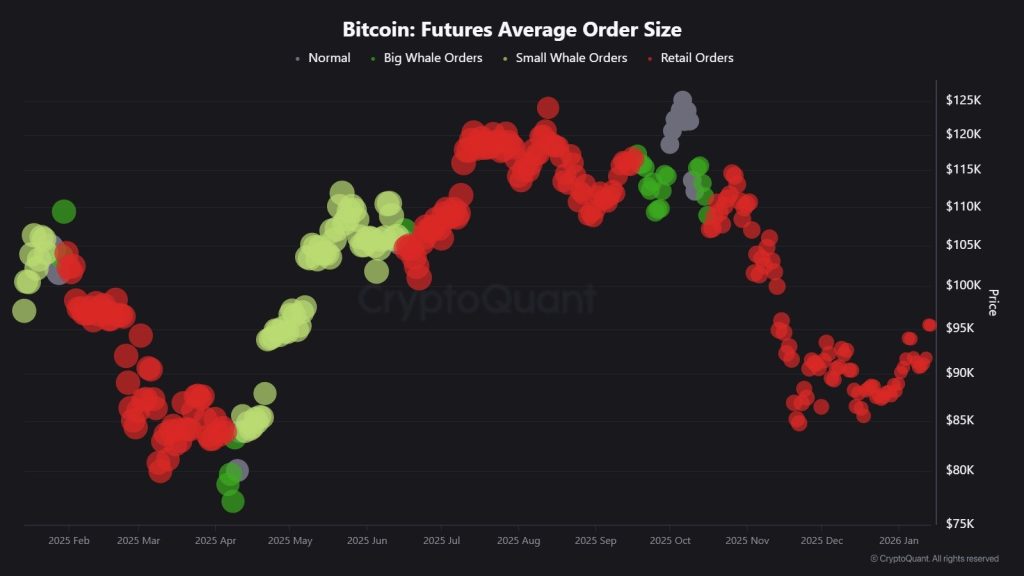

At the same time, Spot Average Order Size confirmed that this demand wasn’t retail-driven. The metric flashed “Whale Orders”, indicating that large entities were stepping in with sizable spot purchases.

This is a critical distinction: the rally was led by capital-heavy buyers using spot markets, not leverage. Historically, spot-led moves tend to be more structurally sound, as they reflect genuine accumulation rather than short-term speculation.

Price action followed this accumulation phase closely. As spot demand strengthened, Bitcoin stabilized and began pushing higher, setting the stage for the breakout toward $96K.

Futures, Retail, and Liquidity Confirm the Trend

While spot markets led, derivatives markets followed. Futures Taker CVD flipped positive later, around $91.4K, signaling that directional buying had spilled over into futures. Although delayed, this alignment reinforced the broader bullish structure and added momentum to the rally’s second leg.

The Futures Volume Bubble Map revealed another layer: increased participation from smaller trade sizes. This suggests that retail traders entered primarily through leveraged futures, rather than spot. In contrast to whales, retail exposure appeared more speculative, chasing momentum rather than initiating it.

Supporting this broader risk-on shift, USDT dominance dropped sharply, according to TedPillows’ analysis. Falling stablecoin dominance typically signals liquidity rotating back into Bitcoin and altcoins, which aligns with the observed spot accumulation and expanding futures participation.

The data paints a coherent picture. Whales led the move via spot markets, futures confirmed strength later, and retail followed through with leverage. Bitcoin’s climb to $96K wasn’t sudden or random; it was methodically built, signalled early, and validated across multiple on-chain and market structure indicators.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |