Australia Fines BPS Financial $9.67M Over Qoin Wallet Promotion

In Brief

- BPS Financial fined $9.67M for misleading promotion and unlicensed crypto services.

- Federal Court imposes a 10-year ban on BPS from offering financial services.

- ASIC signals tougher crypto oversight as Bitcoin trades near $87,600.

Australia’s financial regulator has imposed heavy penalties on BPS Financial for promoting and operating a crypto product without proper authorization. The action marks one of the strongest enforcement outcomes against a crypto firm in the country.

Court Finds Misleading Conduct and Unlicensed Crypto Services

BPS Financial received fines totaling A$14 million ($9.67 million) for misconduct linked to the Qoin Wallet product. The Federal Court imposed A$12 million for misleading and deceptive conduct and A$2 million for unlicensed financial services.

The ruling followed findings that the firm promoted Qoin as a non-cash payment facility tied to a crypto token. The Australian Securities and Investments Commission (ASIC) reported the decision on 27 January 2026.

ASIC said BPS falsely claimed its Qoin token could be exchanged for Australian dollars. The court also found the company lacked an Australian Financial Services Licence.

Judges ruled that BPS engaged in unlicensed conduct for more than three years. In a later decision, the court extended that finding to an additional ten-month period. The firm failed to qualify for exemptions under the Corporations Act.

ASIC confirmed that BPS must publish adverse publicity notices on the Qoin Wallet application.

The company must also request similar notices on the Qoin website. Additionally, BPS must cover most legal costs incurred by the regulator.

Ten-Year Ban Signals Tighter Crypto Enforcement in Australia

The court banned BPS Financial from operating a financial services business without a licence for 10 years. ASIC Chair Joe Longo said providers of crypto products must hold proper authorisations.

ASIC noted the case sends a strong deterrent signal to the digital asset sector. The regulator highlighted unlicensed advice and misleading conduct as ongoing industry risks. These concerns also appeared in ASIC’s recently released 2026 risk outlook.

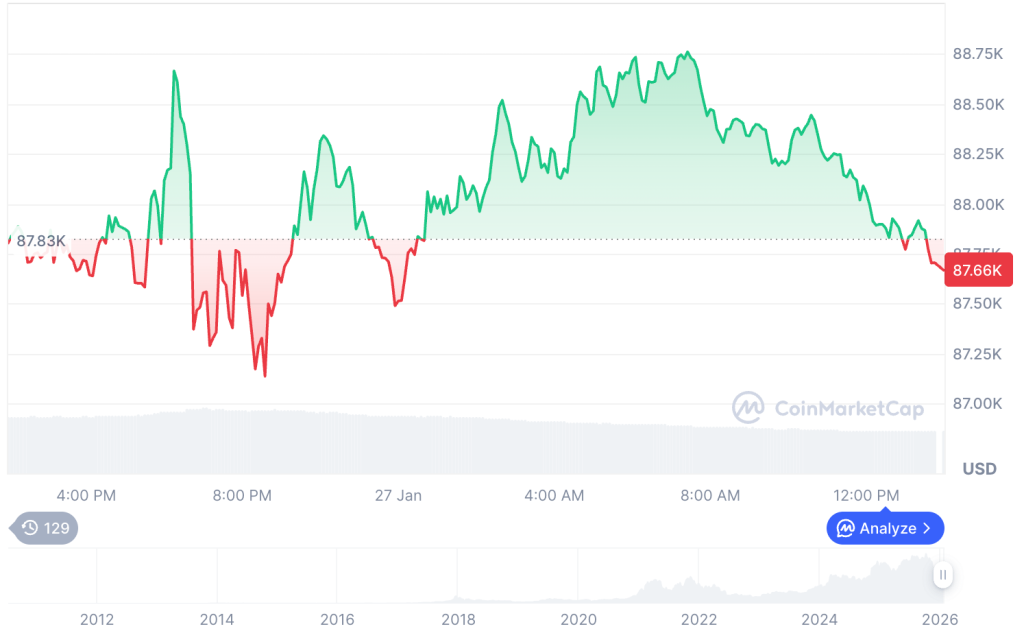

Meanwhile, broader crypto markets showed mild weakness. According to CoinMarketCap data, Bitcoin traded near $87,653, down 0.13% hourly, 0.17% daily, and 3.87% weekly.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |