Top 1% Holders Steady as DOGE Eyes $1.30 With Key $0.21 Resistance

In Brief

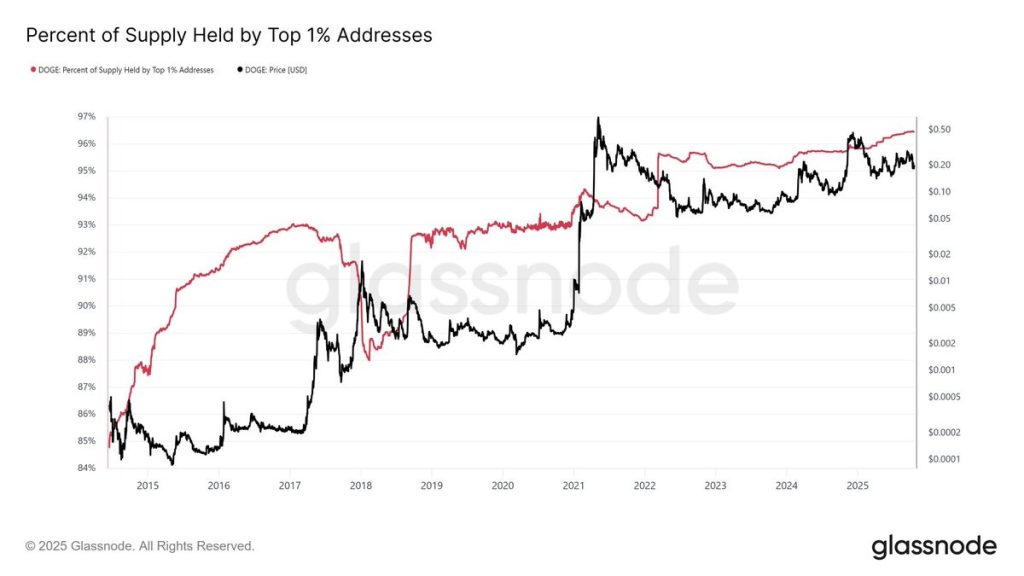

- Top 1% of Dogecoin wallets continue holding 97% of total supply, showing strong conviction

- DOGE forms bullish iH&S pattern, with price targeting $0.216–$0.22 if breakout holds

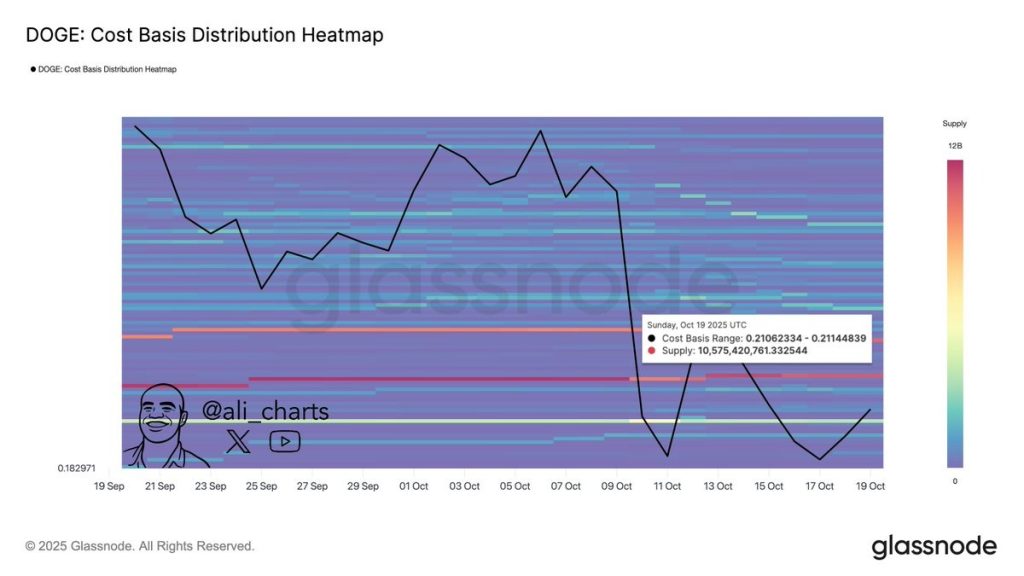

- $0.21 remains key resistance as 10.57B DOGE were accumulated within that cost range

Dogecoin’s top 1% of addresses still control nearly 97% of its total supply, according to Glassnode data. This unchanged concentration highlights strong holder conviction despite recent price movements and volatility.

With the price gradually rising, analysts expect a possible move toward the $1.30 target if demand continues building. The limited distribution reinforces bullish expectations, as large holders maintain dominance over new inflows and trading volumes.

Chart Patterns Show Strength, But $0.21 Zone Poses Challenge

Technical charts reveal DOGE trading between $0.1875 and $0.2120 within an ascending channel on the 4-hour timeframe. This pattern supports a bullish continuation, showing higher highs and higher lows over the past few sessions.

Meanwhile, analyst projections identify a developing inverse Head and Shoulders (iH&S) pattern, which signals a possible trend reversal. A confirmed breakout above the $0.20 neckline could lift prices toward the $0.216–$0.22 range.

Glassnode’s cost basis analysis shows that around 10.57 billion DOGE were accumulated between $0.2106 and $0.2114. This forms a key resistance cluster near $0.21, which may act as a rejection point if buying volume weakens.

The heatmap shows warm colours near that range, suggesting many holders could sell into strength during a retest.

According to CoinMarketCap, Dogecoin currently trades at $0.1937, posting a minor 0.02% hourly gain. However, it has dropped 3.47% in the last 24 hours and 2.25% over the week, reflecting short-term selling pressure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |