Ethereum Staking Activity Surges as Validator Exit Queue Hits Zero

In Brief

- Ethereum’s exit queue drops 99.9%, signalling a sharp drop in selling pressure

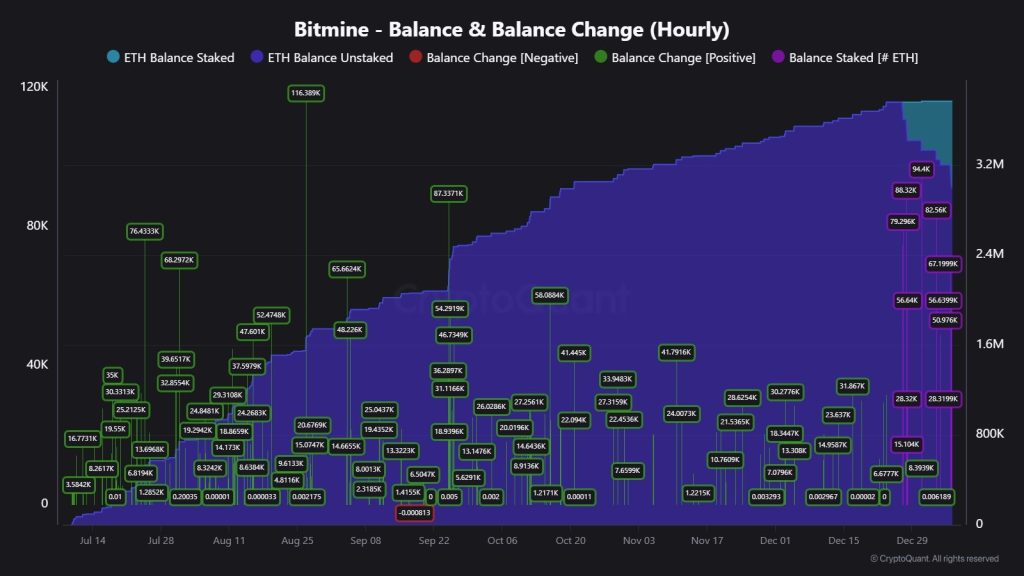

- BitMine stakes 659K ETH, now holding over 3.4% of the Ethereum supply

- ETH price rises to $3,220 amid growing staking interest and network confidence

Ethereum’s validator exit queue has nearly emptied, signalling a major shift in staking sentiment this week. The queue now holds only 32 ETH, down 99.9% from the September peak of 2.67 million ETH. At present, validators can exit in under one minute, suggesting market stability has improved.

Meanwhile, the staking entry queue has climbed to 1.3 million ETH, the highest since mid-November 2025. This shift shows that more holders are locking up ETH rather than withdrawing it. Investors now appear more confident in Ethereum’s long-term performance and staking rewards.

Large institutions continue to lead the trend, with BitMine playing a central role in recent staking flows. The company began staking after December 25 and added 82,560 ETH worth about $260 million on January 3. BitMine’s total staked position now stands at 771k ETH, 18.6% of their total ETH.

Staking ETFs and Market Stability Bolster Ethereum Outlook

The staking landscape is evolving as ETFs also begin distributing rewards directly to shareholders. Grayscale’s Ethereum Staking ETF paid its first dividend of $0.083178 per share for the Oct-Dec period. This marks the first time a U.S. Ethereum ETF passed staking rewards through to investors.

Ethereum now supports over 975,000 validators securing 35.67 million ETH, according to recent network data. Lido DAO leads with 22.08% of all staked ETH, followed by Binance, and Ether.fi, Coinbase, and Figment.

At the same time, Ethereum’s price has risen 1.91% over the last 24 hours to $3,240. This price action aligns with the shrinking exit queue and rising entry queue. Analysts note that such patterns reduce selling pressure and could support higher prices ahead.

BitMine now holds 4.14 million ETH, about 3.4% of the total supply, worth nearly $13 billion. It continues staking aggressively while expanding its broader crypto portfolio. The firm’s actions reflect growing institutional belief in Ethereum’s 2026 growth potential and network stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |