Kraken-Backed Ink Launches Tydro Lending Protocol on Ethereum

- Kraken-backed Ink launches Tydro, a lending protocol on Ethereum.

- Total locked value of on-chain assets exceeds $140 million.

- Integration with Kraken products planned, boosting DeFi ecosystem.

On October 15, Kraken-backed Ethereum Layer 2 network Ink launched Tydro, a white-label lending protocol, offering key financial assets and promising infrastructural advancements for the Ink ecosystem.

The $140 million TVL of Ink signals its potential impact on the DeFi market, with Kraken’s integration plans highlighting a significant move in blockchain financial solutions.

Tydro Launch Marks $140M TVL Milestone on Ethereum

Andrew Koller, Ink’s founder, spearheads this platform to advance its DeFi infrastructure. Users can earn points for future airdrops and utilize supported assets including wETH, kBTC, and others.

The introduction of Tydro strengthens Ink’s role in the DeFi space, with a total locked value exceeding $140 million. Immediate plans to integrate Tydro into Kraken’s products suggest a growing alignment between centralized and decentralized finance, broadening user engagement.

Market sentiment around Ink’s deployment is largely positive. The absence of direct regulatory discourse hasn’t overshadowed the enthusiasm in the crypto community. Although top-tier influencers have yet to comment, expectations are high given Ink’s ambitious platform features.

DeFi and CeFi Integration Poised for Future Growth

Did you know? The launch of Tydro coincides with a shift by major exchanges into DeFi, similar to Binance’s BNB Chain, highlighting increasing adoption of integrated financial solutions.

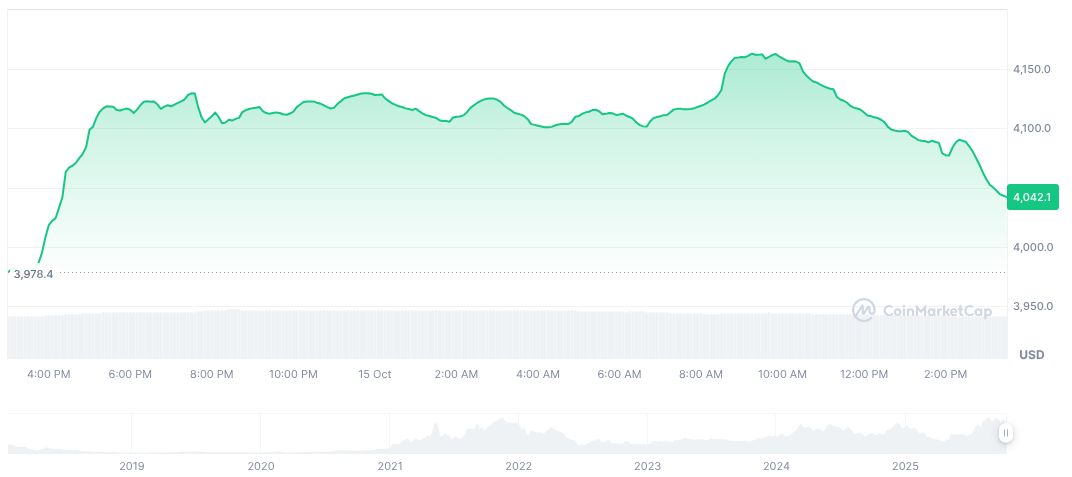

According to CoinMarketCap, Wrapped Ethereum (WETH) holds a market cap of $13.65 billion with prices at $4,043.14. Despite a 90-day rise of 18.36%, recent trends show a drop of 9.43% over seven days, influencing Ethereum Layer 2 dynamics.

Insights from the Coincu research team highlight Tydro’s potential to increase financial participation. The emphasis on user-friendly DeFi and integration with existing platforms like Kraken promises technological advancement and broader market reach.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |