Key Points:

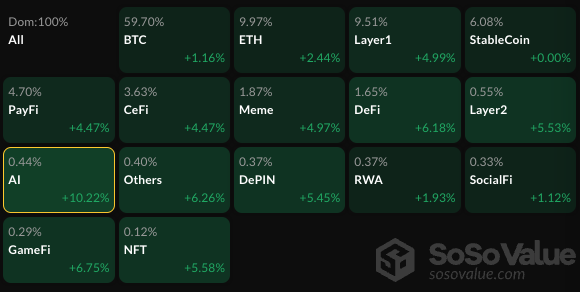

- The AI cryptocurrency sector outperformed the broader market with significant gains.

- AI Agents led with a substantial 10.22% increase during market rebound.

- AI16Z surged 21.14%, showcasing strong performance in AI cryptocurrencies.

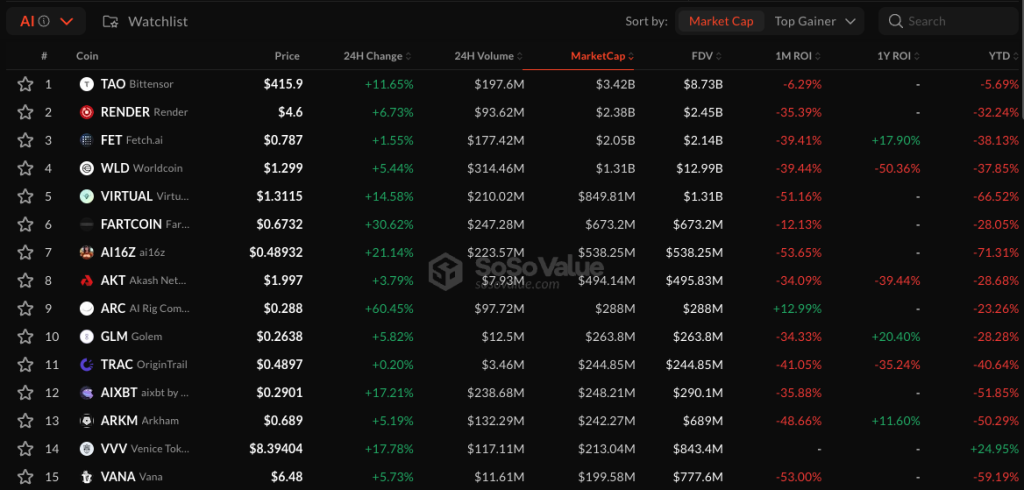

The cryptocurrency market recently rebounded, with the AI sector and its sub-sector, AI Agents, leading the gains. AI Agent coins increased by 10.22%, while Bittensor (TAO) rose by 11.65%. AI16Z surged by 21.14%, and the AI Rig Complex (ARC) reported a rise of 60.45%.

Overall, the CoinMarketCap 100 Index reflected a slight upward trend. These figures point to strong growth potential within AI cryptocurrencies, with further intriguing details available.

AI Agent Coins Boom: TAO, AI16Z, and ARC Lead Gains

The AI cryptocurrency sector has outperformed the broader market, with AI Agents rising by 10.22%. Bittensor (TAO) saw an 11.65% increase, while AI16Z surged 21.14%.

The AI Rig Complex (ARC) excelled with a remarkable 60.45% rise, and the VIRTUAL ecosystem token AIXBT climbed by 17.21%.

These impressive gains highlight the AI sector’s strong growth potential in the competitive cryptocurrency landscape.

CMC100 Index Rises 0.95% But Stays Below $200

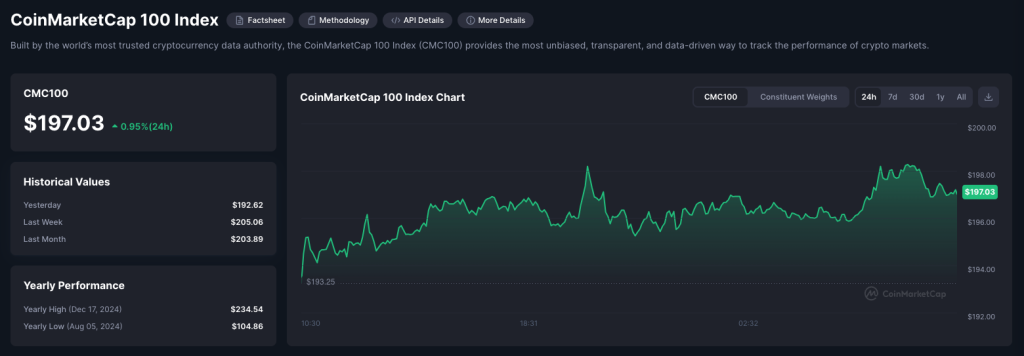

The CoinMarketCap 100 Index (CMC100) currently stands at $197.03, reflecting a 0.95% increase over the last 24 hours.

Despite this uptick, it has declined from last week’s $205.06 and last month’s $203.89. Nevertheless, it remains above the yearly low of $104.86, indicating overall growth.

Recent price fluctuations kept the index below $200, highlighting volatility while still showing a slight upward trend.

Bitcoin Holds $1.94T as Ethereum’s Market Share Declines

The Fear and Greed Index is at 37, indicating a fearful sentiment and potential buying opportunities.

Bitcoin’s market cap stands at $1.94 trillion, while Ethereum’s decreases to $322.46 billion, signaling a loss in market share. Besides, the Altcoin Season Index is at 39, underscoring Bitcoin’s dominance.

High open interest in futures reflects active trading, and Ethereum demonstrates greater volatility than Bitcoin, suggesting significant short-term price fluctuations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |