- The Altcoin Season Index dropped to 34, indicating altcoin underperformance against Bitcoin.

- Altcoin dominance declines as top projects lag behind BTC.

- Investor sentiment shifts towards Bitcoin amidst declining index.

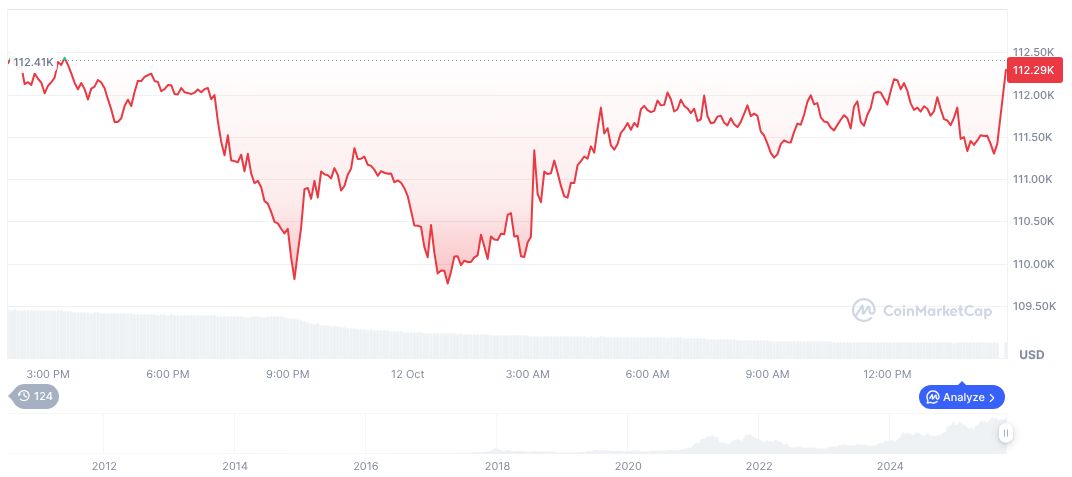

The Altcoin Season Index, maintained by CoinMarketCap, has decreased to 34 on October 12, marking a significant drop from 78 recorded on September 20.

This decline implies a shift towards Bitcoin dominance, potentially affecting investor strategies and market sentiment in the cryptocurrency sector.

Altcoin Index Plummets: Bitcoin Dominance Surges

Recent data from CoinMarketCap indicates a significant drop in the Altcoin Season Index to 34, showing fewer projects outperform Bitcoin. Since September 20, the index has steadily fallen, signifying a considerable shift in market dynamics. This change suggests a return to Bitcoin’s dominance, potentially influencing long-term investment strategies.

The current decrease implies a downturn in altcoin performance, marking the end of a temporary altcoin period observed in late September. Investor attention may be shifting more towards secure and stable investments, notably in Bitcoin.

“Historical patterns show that periods of declining altcoin performance often coincide with Bitcoin’s resurgence in market interest.” — Arthur Hayes, Co-founder, BitMEX

Market Shifts: Historical Patterns and Price Changes

Did you know? During the 2017 and 2018 altcoin booms, similar patterns of altcoin dominance ended with Bitcoin reclaiming market control, hinting at possible cyclical trends in cryptocurrency markets.

Bitcoin currently trades at $114,928.76 with a market cap of $2.29 trillion, holding a 58.79% dominance according to CoinMarketCap. Over the last 24 hours, its price increased by 3.73%, though it experienced a 6.36% decrease over the past week.

Insights from Coincu suggest potential market stabilization as investors reallocate funds towards Bitcoin. Regulatory developments remain uncertain, but a focus on mainstream digital currency adoption could accelerate further blockchain technology integration.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |