- Binance reportedly plans to shift SAFU fund assets to Bitcoin in 30 days.

- Sources contradict the identified move to Bitcoin reserves.

- Questions linger about asset security and market strategies.

Binance, a leading cryptocurrency exchange, announced adjustments to its SAFU fund, intending to gradually convert a $1 billion stablecoin reserve into Bitcoin within 30 days.

This conversion reflects Binance’s commitment to long-term cryptocurrency support, signaling potential market impact as it aligns with Bitcoin’s valuation importance in the crypto ecosystem.

Binance’s Strategic Pivot: $1 Billion USDC to Bitcoin

Reports suggest Binance aims to transform its SAFU fund’s $1 billion USDC reserves into Bitcoin. These adjustments are meant to take place over the next 30 days, representing a strategic pivot reflecting confidence in Bitcoin’s potential.

Conflicting reports question the certainty of this plan. Official Binance documentation only confirms the current SAFU holding as USDC, casting doubt on the authenticity of statements regarding the shift. The implications of maintaining safeguards and supplementing Bitcoin to stabilize the SAFU fund remain speculative.

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

Crypto community reactions are varied. Industry stakeholders express curiosity and skepticism, reflecting on the absence of formal statements from Binance executives. Concerns arise over market stability and asset protection.

Historical Trends and Expert Analysis Challenge Binance’s Move

Did you know? The SAFU fund, established in 2018, has always used stablecoins to cushion market volatility. This potential shift to Bitcoin could mark the first time Binance engages Bitcoin within its key security fund.

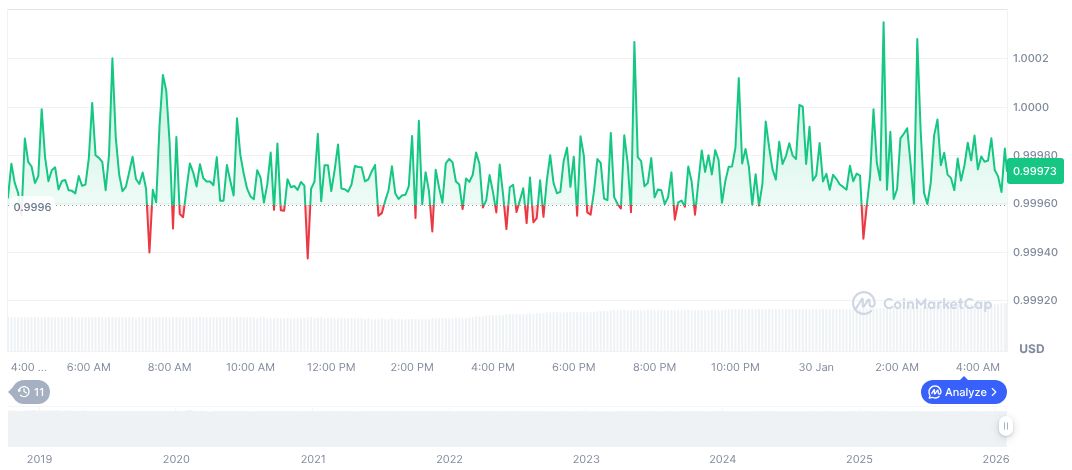

CoinMarketCap data shows USDC’s current value at $1.00, sustaining a market cap of $70.21 billion and a 24-hour trading volume increase of 36.74%, marking minor price shifts across timeframes. USDC remains robust, holding a significant slice of market dominance despite rumors of fund conversion to Bitcoin.

Coincu research suggests complexities in this shift, raising questions on technological infrastructure and regulatory reactions. Historical trends in similar market efforts highlight potential pitfalls or stabilization benefactors, reinforcing the influence of strategic messaging and transparency on investor confidence.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |