- Binance’s USDe yield program caused severe market disruption on October 10.

- Hundreds of billions liquidated across the crypto market.

- Experts debate responsibility and future regulatory implications.

On October 10, Binance’s USDe yield program led to substantial market disruptions, causing hundreds of billions in liquidations and surpassing the impact of the FTX collapse, according to OKX CEO Star.

The incident highlights potential risks in high-yield crypto offerings and triggered regulatory scrutiny, emphasizing the fragile balance of leveraging in decentralized finance ecosystems.

Binance USDe Sparks $283 Million in Compensation Needs

Market participants faced widespread chaos after Binance’s USDe program encouraged users to exchange USDT and USDC for USDe, promising substantial returns. Many users used USDe as collateral, exacerbating risks and leverage. According to OKX CEO Star, the system created artificial annualized yields exceeding 70%.

Star Xu (Haider Rafiq), CEO, OKX, criticized Binance’s approach: “Binance’s irresponsible marketing of USDe yields without risk emphasis enabled leverage cycles that led to the market crash.” Techflowpost

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

With volatility impacting the market, the risks materialized as USDe quickly depegged, causing a chain of liquidations. OKX users and others experienced significant losses as WETH and BNSOL risks further amplified the situation. Binance supplied $283 million in compensation to affected parties, highlighting serious risk management challenges.

Leadership and Regulatory Scrutiny Heighten Post-Crash

Did you know? The USDe yield-induced market crash paralleled the 2022 Luna/UST collapse, prompting discussions on synthetic stablecoins’ inherent risks, despite previous vows for increased caution.

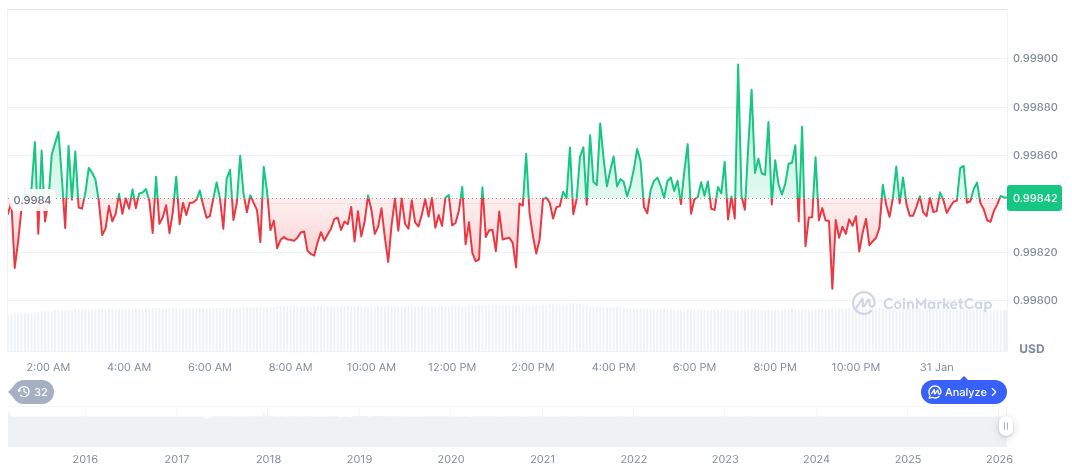

Tether USDt (USDT), maintaining a consistent $1.00 despite recent turbulence, holds a market cap of $185.27 billion, third globally with a 6.78% market dominance. Over the past 24 hours, its trading volume reached $111.55 billion, as reported by CoinMarketCap.

Multiple outcomes stem from this event. The Coincu research team suggests intensified regulatory scrutiny on platforms offering synthetic stablecoins. Potential technological advancements include enhanced risk assessment tools to prevent similar systemic shocks in the future.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |