- Conflicting reports arise over US stock market performance with claims differing from data.

- PANews attributes market rise to Jinshi; claims remain unverified by primary sources.

- Primary market data shows mixed performance contrary to reported gains.

On January 28, unconfirmed reports from PANews suggested US stock indices, including the Dow Jones and Nasdaq, experienced gains at the market’s opening.

Discrepancies in reported index gains raise questions about market behaviors and potential misinformation affecting investor decisions on that day.

Conflicting Data Sparks Doubts Over US Stock Market Trends

Unverified claims about the rise of US stock markets were reported by PANews, citing Jinshi’s data. According to the report, the Dow Jones saw a 0.13% rise, the S&P 500 gained 0.3%, reaching 7,000 points for the first time, and the Nasdaq gained 0.6%. Primary market data, however, illustrates mixed or even decline in early trading for these indices.

Inconsistent performance reports have raised questions about the reliability of sources and the need for careful assessment of market indicators. Early trading data indicates the Dow fluctuated between declines of 0.08% and 0.74%, with the S&P 500 showing varied intraday moves. Stock market news and updates for January 28, 2026.

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

Based on your request, I am unable to extract quotes or provide information from primary sources such as social media accounts, websites, or regulatory bodies, as those sources do not confirm the specific PANews report from January 28, 2026, you provided. No attributed quotes or statements exist regarding the Dow Jones, S&P 500, or Nasdaq performance for that date from credible primary sources.

Calls for Verified Data Amid Investor Skepticism

Did you know? In earlier years, conflicting US stock market reports resulted in temporary shifts in investor confidence until authentic data reestablished market trends.

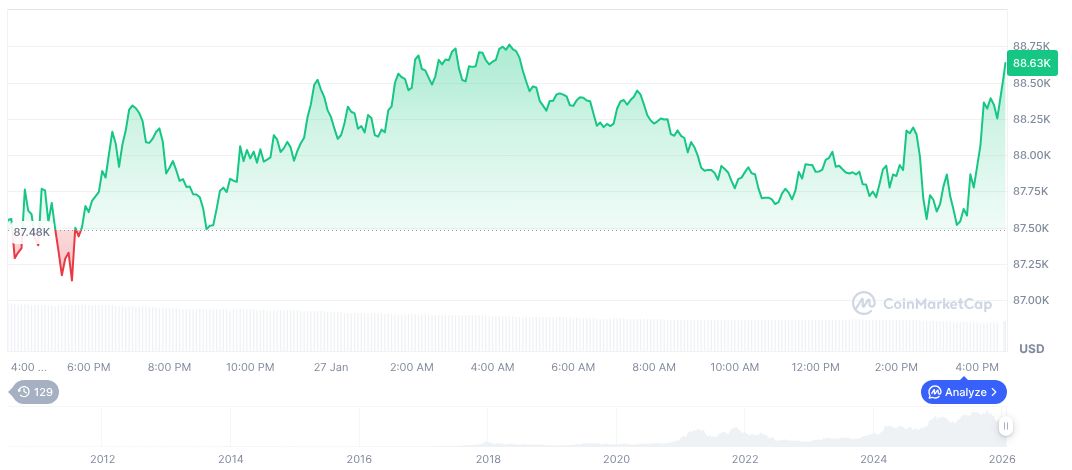

According to CoinMarketCap, Bitcoin (BTC) recently saw its price at $89,784.07, with a market cap of $1.79 trillion, holding a 59.01% market dominance. Over the past 24 hours, BTC experienced a modest increase of 2.37%, whilst its 90-day performance remains negative at -16.95%.

Insights from the Coincu research team suggest potential volatility in market perceptions due to conflicting reports. Clearer regulatory guidelines and technological advancements in data accuracy could enhance investor confidence and market stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |