Bitcoin Whales Trigger Market Volatility Amidst US Stock Decline

- Bitcoin whales influence market volatility through significant BTC reallocations.

- Over 36,500 BTC shifted, impacting crypto trends.

- US stocks face declines as economic pressures heighten cross-market effects.

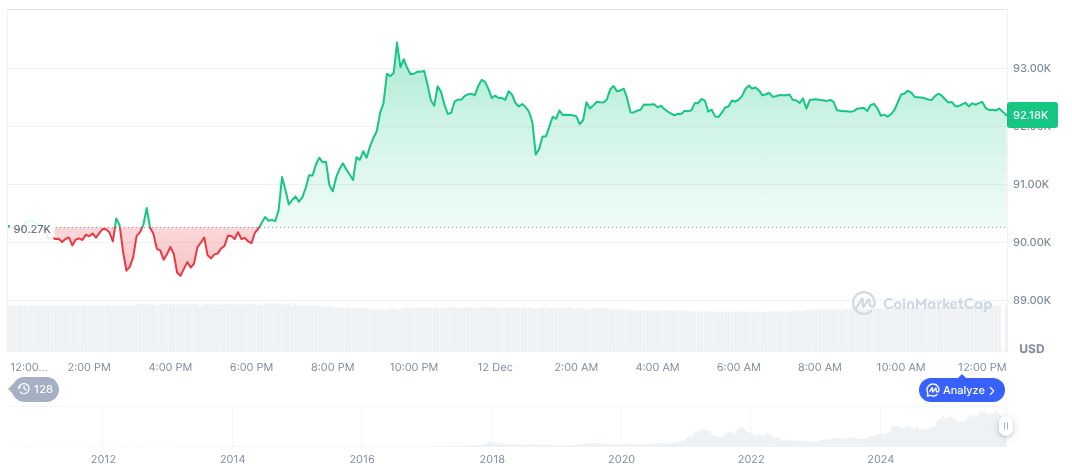

On December 12, U.S. stock indices experienced a downturn, with the Nasdaq losing over 1% and the S&P 500 dropping 0.5%, as reported by BlockBeats News.

The cryptocurrency market also showed turbulence, with significant Bitcoin whale reallocations and Ethereum whale positioning, indicating increased volatility amid broader financial market uncertainties.

Whales Move 36,500 BTC as US Stocks Drop

Despite the fall in stock indices, the cryptocurrency market also experienced fluctuations, with major Bitcoin movements suggesting potential volatility. These reallocations could influence short-term trading strategies and broader market trends.

The US stock market saw significant activity as indices like the Nasdaq and S&P 500 fell, while Bitcoin whales moved approximately 36,500 BTC. Such reallocation by key market entities suggests potential impact on market stability. These changes possibly influenced both immediate cryptocurrency pricing and future investor strategies.

While no official statements from key figures directly commented on the day’s market dynamics, whale activity’s impact on the crypto market remains a critical point of observation. Regular monitoring of these trends could offer insights for future market behavior.

Historical Context, Price Data, and Expert Analysis

Did you know? Bitcoin whales adjusted their holdings amidst a broader market downturn, echoing past instances where large BTC movements heralded significant price shifts.

According to CoinMarketCap data, Bitcoin’s current price stands at $90,250.40, with a market cap of $1.80 trillion. The recent 24-hour change shows a 2.87% decline, while the 7-day change remains slightly positive at 0.90%. BTC’s trading volume reached $81.39 billion, marking a significant rise, which possibly reflects on these whale-induced activities.

Coincu research highlights the potential implications of these movements, as regulatory and technological changes may amplify these effects. Historical data indicate that similar patterns often lead to both short-term price fluctuations and strategic long-term gains.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |