- Citigroup revises crypto stock targets due to market dip.

- Still positive outlook for digital asset investments.

- Circle Financial remains top pick despite stock drop.

Citigroup’s latest report, dated December 20th, revised target prices for certain crypto stocks following market declines, yet maintains a positive outlook on digital asset stocks.

This reassessment highlights potential investment opportunities despite volatility, with Circle Financial as a favored choice, reflecting institutional confidence in the digital assets sector.

Citigroup Revises Crypto Stock Prices Amid Decline

Citigroup has updated its digital asset stock report, adjusting target prices of several crypto stocks following a market decline. Stablecoin issuer Circle Financial (CRCL) remains Citigroup’s top pick, with its target price reaffirmed at $243 despite a drop to $83.60.

Bullish (BLSH) and Coinbase (COIN) follow as Christiansen’s next picks, highlighting the potential benefits from increased institutional investor participation. BLSH’s target price was lowered to $67, offering significant upside from $44.

Market observers note mixed reactions as token volatility continues to affect stock prices. Despite adjustments, Citigroup maintains its optimistic stance on digital asset stocks’ future.

“It appears that no direct quotes from primary sources or officials have been found in the material provided. Consequently, there aren’t any quotes from key players, leadership, or industry experts to extract.”

Bitcoin’s Decline and Potential Recovery Scenarios

Did you know? Citigroup’s stock price adjustments come amid a larger context of market volatility, reflecting historical patterns where crypto stocks rebounded after previous declines, underscoring the fluctuating nature of digital assets.

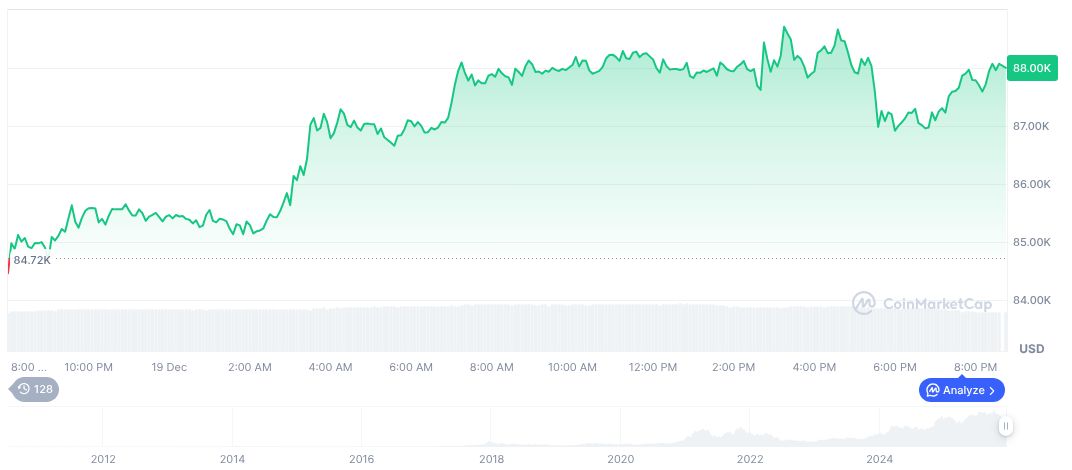

Bitcoin (BTC) currently trades at $88,206.19, playing a dominant role with a market cap of 1.76 trillion USD or 59.05% dominance. Recent months saw a 23.77% decline, with the circulating supply near its maximum. Data sourced from CoinMarketCap (as of December 19, 2025).

Insights from the Coincu research team indicate potential recovery scenarios, driven by regulatory adaptations and technological advancements in blockchain networks. Historical trends suggest volatility may precede growth, offering significant opportunities to well-positioned market participants.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |