CoinShares Reports Significant Digital Asset Outflows Amid Fed Speculations

- CoinShares reports $454 million weekly crypto outflows.

- Bitcoin and Ethereum experience major investment declines.

- Investors shifting focus to altcoins amid market volatility.

CoinShares reported a net outflow of $454 million from digital asset investment products last week, primarily due to reduced expectations of a Federal Reserve interest rate cut in March.

This shift highlights investors’ sensitivity to interest rate movements and potential market volatility, influencing digital asset allocations and impacting Bitcoin and Ethereum significantly.

Market Dynamics and Expert Insights Amid Predominant Trends

Bitcoin and Ethereum faced the brunt of this outflow, with individual losses of $405 million and $116 million. Conversely, Solana and XRP saw significant interest. This redistribution suggests investors are seeking refuge in altcoins amid Bitcoin and Ethereum’s volatility.

Reaction from global markets was mixed. The U.S. experienced a significant outflow, while Germany, Canada, and Switzerland reported inflows. Financial analysts are closely watching how this trend develops, emphasizing the need for caution in light of recent events.

Did you know? In early 2026, digital asset outflows nearly offset the $1.5 billion net inflow since the year’s start, reflecting the impact of changing Federal interest rate expectations on investment sentiment.

Market Data and Future Insights

Did you know? In early 2026, digital asset outflows nearly offset the $1.5 billion net inflow since the year’s start, reflecting the impact of changing Federal interest rate expectations on investment sentiment.

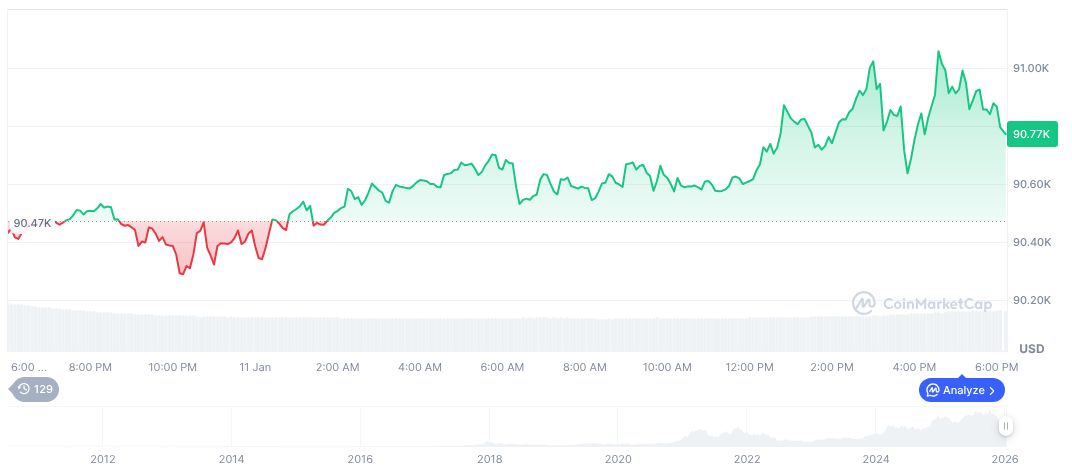

As of January 12, 2026, Bitcoin’s market cap sits at $1.81 trillion, commanding a 58.49% dominance in the crypto market according to CoinMarketCap. Its current price of $90,467.86 reflects a 2.59% decline over seven days, signaling investor caution amid shifting Federal Reserve policies.

Coincu experts suggest potential implications include increased volatility for Bitcoin if interest rates remain unchanged. Regulatory shifts in the EU and further ETFs are central to 2026’s outlook. “Global digital asset inflows reached US$47.2B in 2025, just shy of the 2024 record, with the year starting strongly despite midweek volatility,” according to the CoinShares Research Team. Market participants remain vigilant as these financial landscapes continue to evolve.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |