- Adam from Greeks.Live releases briefing on bear market consolidation.

- Bull market anticipated post-Christmas 2026.

- Retail investors face challenges in current BTC cycle.

Greeks.Live researcher Adam released a market briefing on December 30, emphasizing a bearish phase in cryptocurrency markets, with expectations for a bull market only after Christmas 2026.

The briefing highlights market consolidation and influences on Bitcoin’s expected patterns, triggering significant interest among investors monitoring cryptocurrency trends and market stability.

Prolonged Bear Phase Expected Until Late 2026

Greeks.Live researcher Adam shared insights indicating a prolonged bear phase in the cryptocurrency market, suggesting BTC might not see bullish trends until post-Christmas 2026. This perspective highlights concerns about market dynamics and retail investors’ profitability challenges. Institutional forces dominate, shaping price pressures and influencing market stability.

Retail investors, struggling to capitalize on previous BTC bull runs, continue to face challenges. In the current cycle, broader institutional influences continue to shape market behavior, maintaining a trend seen in the past three years of BTC’s price activity. Deflationary environments are also under observation, possibly signaling future easing which may stabilize the market.

Adam, Researcher, Greeks.Live, – “Discussions on bear market consolidation and BTC’s three-year bull pattern indicate a delayed bull run until after Christmas 2026.” BlockBeats Report

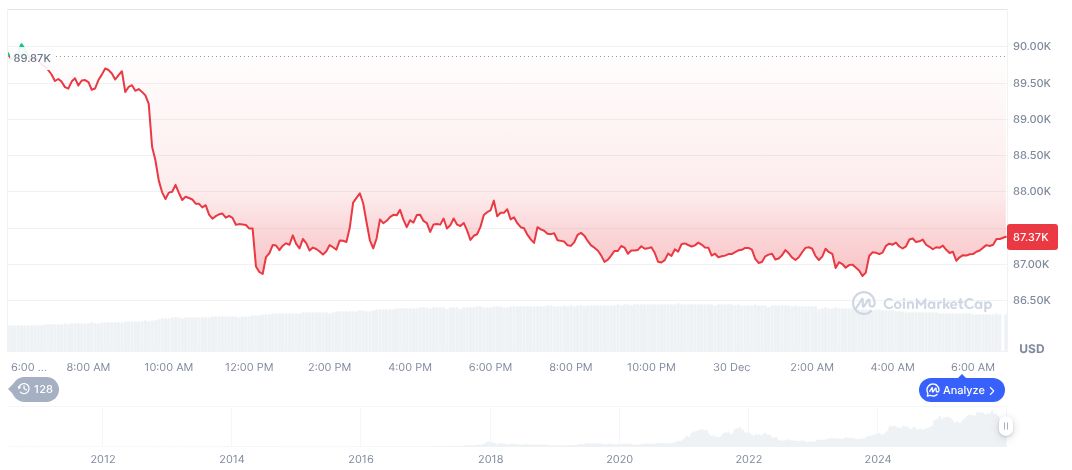

BTC Sees Low Q4 Performance Amid “Crypto Winter”

Did you know? BTC’s worst Q4 since 2018 unfolds amid ongoing “crypto winter,” following historical precedents that challenge retail profitability in prolonged downturns.

Bitcoin, currently priced at $88,243.67, leads the market with a $1.76 trillion capitalization as reported by CoinMarketCap. Market dominance stands at 59.08%, with the latest 24-hour trading volume decreasing by 22.99% to $36.46 billion. BTC’s 30-day price reflects a 3.54% drop, amongst a 19.85% fall over 60 days.

The Coincu research team highlights that the current BTC cycle adheres to previous multi-year patterns, emphasizing potential financial risks but also opportunities in emerging tech sectors like AI. Regulatory and institutional influences remain paramount, as trends in legislation could markedly impact crypto’s future landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |