- Market crash involved complex factors, influenced by API issues and Trump tariffs.

- Event highlights lack of circuit breakers in crypto markets.

- Recovery anticipated as market adapts to macroeconomic challenges.

Dragonfly managing partner Haseeb Qureshi challenges the narrative blaming Binance and Ethena for the October 10/11 market crash, citing factors like API issues and tariff comments as contributors.

The event underscores crypto market vulnerabilities, highlighting the lack of circuit breakers and the amplified impact of external factors, affecting liquidity and investor confidence.

Tariffs, Tech Glitches, and Circuit Breaker Absence

Haseeb Qureshi of Dragonfly highlighted the complex factors causing the October market crash, disputing claims against Binance and Ethena. Bitcoin reached its low before anomalies at Binance became apparent. The USDe deviation was isolated to Binance, lacking a market-wide influence similar to the Terra incident.

Key factors included Trump’s tariff-induced market unease and Binance’s API challenges hindering effective platform hedging. Additionally, high leverage and amplification via Automatic Deleveraging Mechanisms (ADL) exacerbated the decline, exposing the crypto market’s vulnerability due to the absence of circuit breakers.

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

“As the largest global platform, Binance has outsized influence—and corresponding responsibility—as an industry leader. Long-term trust in crypto cannot be built on short-term yield games, excessive leverage, or marketing practices that obscure risk.” — Star Xu, CEO of OKX

Bitcoin Recovery Path and Future Safeguards

Did you know? The October 2025 market crash mirrored past events like Terra, where isolated platform failures highlighted systemic vulnerabilities without market-wide spread.

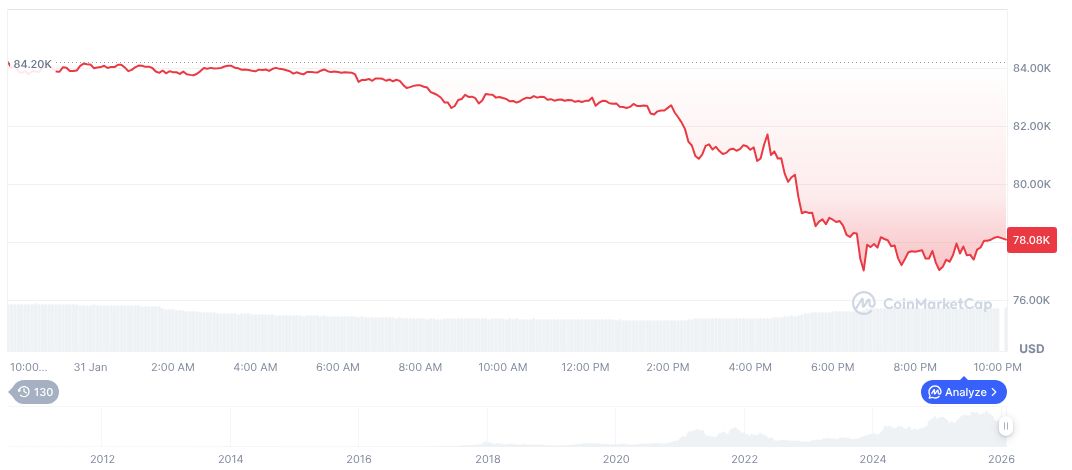

As of February 1, 2026, Bitcoin (BTC) is valued at $78,489.33, with a market cap of $1.57 trillion, reflecting a recent 6.33% price decrease. The cryptocurrency shows a 90-day decline of 28.44%, indicating ongoing volatility. All data sourced from CoinMarketCap highlights Bitcoin’s dominance at 58.98%.

Analysts from Coincu suggest the market’s restoration may involve adopting circuit breakers akin to traditional finance to mitigate future crashes. Technological and policy adjustments could stabilize the market and support a more resilient financial ecosystem in light of macroeconomic pressures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |