- US stock crypto mining companies experience upward stock movement; noted players include Applied Digital and IREN.

- Applied Digital surges over 14%.

- Market dynamics contribute to notable stock valuations.

According to Bitget data on January 28th, US stock crypto mining concept stocks including Applied Digital and IREN experienced significant gains, with the former rising over 14%.

The surge underscores increased investor interest in crypto mining stocks amidst growing market volatility, impacting Bitcoin’s valuation, which remains central to mining operations.

Notable Gains: Applied Digital Surges Over 14%

Crypto mining companies Applied Digital, Iris Energy (IREN), TeraWulf, and Cipher Mining displayed impressive stock rises. Applied Digital led with over a 14% increase, followed by IREN’s 9% surge, and both TeraWulf and Cipher Mining posting gains over 7%. This indicates a renewed investor interest driven by potential mining sector opportunities.

This surge in stock prices coincided with Bitcoin’s market trends, as its value continued to influence the broader crypto landscape. With the positive movement, cryptocurrency mining stocks became attractive options for investors seeking exposure to the volatile yet potentially rewarding space.

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

Based on the search results, there are no direct quotes or statements from key players or leadership at applied companies regarding the January 28th stock surges. As such, it is not possible to fulfill your request for quotes in the specified format. If there’s another aspect or different information you would like to explore, please let me know!

Bitcoin’s Influence and Sector Efficiency Trends

Did you know? Bitcoin’s price movements have historically influenced the stock prices of crypto mining companies.

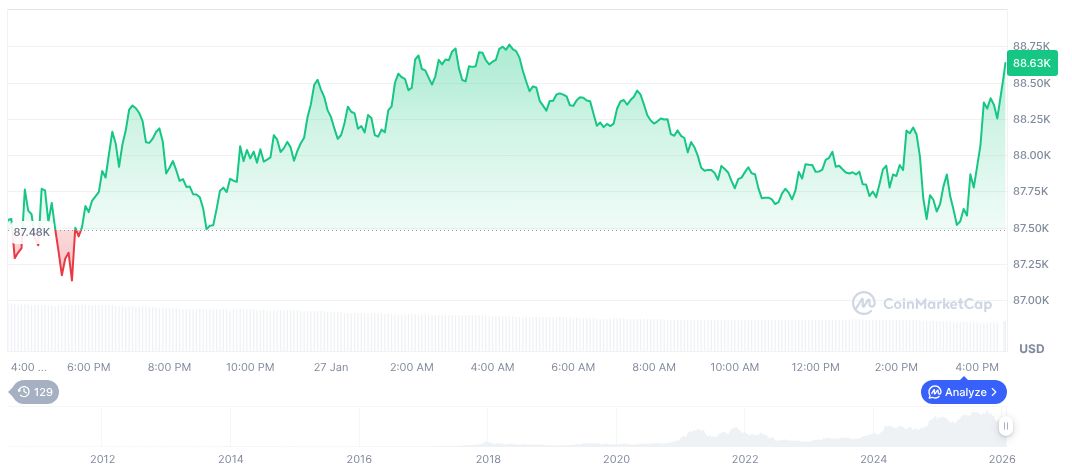

Bitcoin (BTC) continues to play a crucial role in crypto mining dynamics, with its January 27 price sitting at $88,303.95. According to CoinMarketCap, BTC’s market cap stands at $1.76 trillion, amidst a dominance of 58.78% and a 24-hour volume of $34.52 billion. Despite a 0.89% rise over 24 hours, the currency reported a 2.23% decline over the past week.

Research teams highlight potential advancements in mining technologies that could enhance sector efficiency and reduce costs. Historical patterns in market behavior suggest cycles of gain and retracement, perhaps influenced by halving events and regulatory reviews.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |