Cryptocurrency Surges Stemming from Venezuelan Political Unrest

- Bitcoin and Ethereum prices surge as conflict arises between US and Venezuela.

- Cryptocurrencies now show increased correlation with broader financial markets.

- Market rumors suggest Venezuela may hold significant Bitcoin reserves.

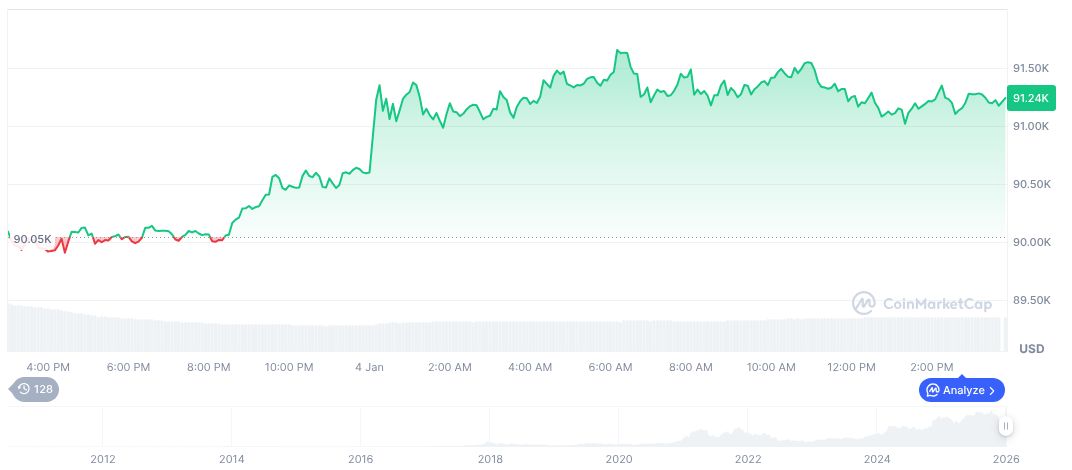

In early January, Singapore-based QCP Capital highlighted a surge in Bitcoin and Ethereum prices amid Asian trading, linked to geopolitical events and financial market changes.

This upward trend signifies a strengthening bullish market dynamic, influenced by geopolitical catalysts and new regulatory environments, potentially impacting future crypto investment strategies.

Cryptos React to US-Venezuela Tensions: Key Price Shifts

Bitcoin and Ethereum rose above $92,000 and $3,100 respectively following heightened market activity associated with Venezuela’s political situation. Notably, oil prices declined and stock markets improved as US actions affected the Venezuelan leadership.

highlighted the potential influence of new US legislation on crypto markets.

The event underscores a growing correlation between crypto assets and global risk factors, such as oil pricing and geopolitical activity. Rumors suggest Venezuela may hold substantial Bitcoin reserves, akin to Strategy’s holdings, possibly adjusting sovereign crypto positions.

The crypto market responded strongly, with Bitcoin options positioning shifting to more bullish stances. Over 3,000 call options with a $100,000 strike have been recorded, indicating heightened future momentum expectations.

warns of possible price retracements, as evidenced by recent US market withdrawals.

Bitcoin Market Dynamics: Historical Patterns and Current Data

Did you know? Historical patterns show Bitcoin price movements often parallel geopolitical tensions, impacting the broader asset class.

As of January 5, Bitcoin trades at $92,701.34, after a 1.42% increase over 24 hours. The market cap stands at 1.85 trillion and displays 58.77% dominance across the crypto market. The 24-hour trading volume surged by 35.32%, reflecting market participants’ active engagement, according to CoinMarketCap data.

Insights from the Coincu research team indicate the global political climate and rumored Venezuelan Bitcoin reserves may impact crypto valuations. Technological adoption and legislative changes further shape these outlooks, highlighting the role of market sentiment and institutional interest.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |