- Prominent Bitcoin whale shorts 1,423 BTC, sparking market reactions.

- Trade valued at approximately $161 million.

- Sentiment shifts as BTC and ETH experience volatility.

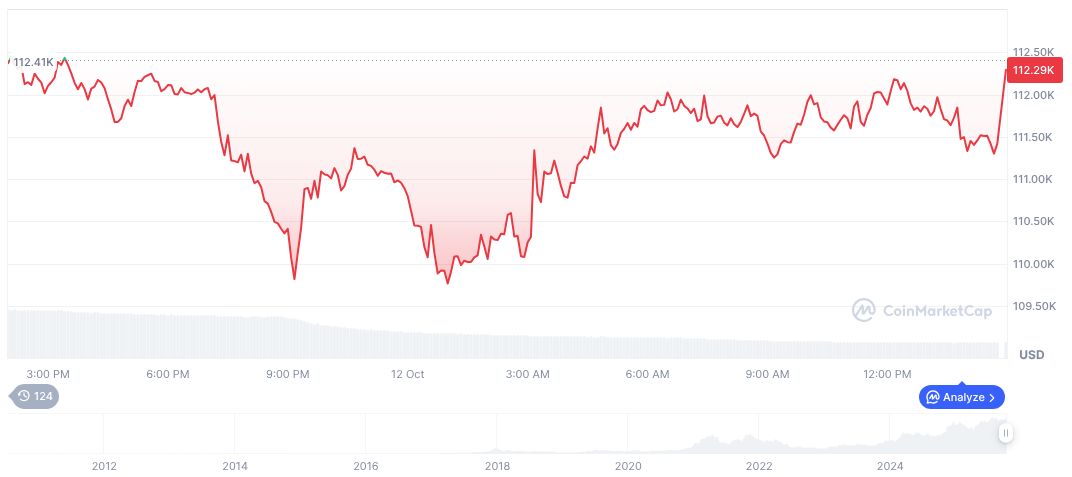

An influential Satoshi-era Bitcoin whale recently shorted 1,423 BTC worth around $161 million, triggering considerable market analysis and discussions about potential price impacts on October 12.

This move signals heightened market unease, affecting BTC and ETH prices, raising concerns of a possible broader market correction among cryptocurrency stakeholders.

Bitcoin Whale’s Strategic Moves Trigger Market Volatility

Bitcoin’s market noted a significant transaction when an early whale initiated a short position involving 1,423 BTC. Lookonchain shares a snapshot of market data analysis related to this transaction. The whale, recognized for strategic asset rotation, leveraged this sale on decentralized derivatives platforms, exacerbating bearish sentiment. Analysts tracked the trade, highlighting its implications for both Bitcoin (BTC) and Ethereum (ETH).

Immediate market impact included notable volatility in BTC’s price around $120,000, followed by broader caution across the market. As traders reacted, Ethereum mirrored BTC’s movement, struggling to maintain bullish trends amidst uncertainty. The combined BTC and ETH leveraged short positions now approach $1.1 billion, underpinning intensified scrutiny.

Spam speculation intrigued experts who noted the trade’s timing and potential inside insights. Known analytics accounts and industry insiders are abuzz, debating possible motivations and unintended consequences for retail market participants amidst increased exchange inflows.

Lookonchain, Blockchain Analyst, remarked on the timing: “Did he have insider information?”

Historical Patterns and Expert Insights on Whale Activity

Did you know? In August 2025, whale activities including a $5B BTC to ETH shift led to BTC depreciation. Historical moves often precede 10-20% corrections.

As of October 12, 2025, Bitcoin (BTC) trades at $113,278.54 with a market cap nearing $2.26 trillion. Despite recent volatility, BTC maintains dominance at 58.98%. Weekly metrics saw a 7.76% decline while monthly losses reached 1.64%.

Analysts such as Coincu predict regulatory discussions and technological innovations may track these shifts in whale behavior. Historical precedent suggests strategic asset management could impose long-term market diligence. Experts emphasize substantial whale activity often correlates with market adjustments, urging caution amid speculative trading dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |