ECB Maintains Interest Rates, Predictable Cryptocurrency Market Response

- ECB keeps deposit facility rate at 2% for the fourth consecutive meeting.

- Cryptocurrency markets show minimal volatility expectations.

- Lack of new regulation maintains crypto stability.

The European Central Bank announced on December 18th that it would maintain the deposit facility rate at 2%, marking the fourth consecutive meeting without changes.

The decision aligns with market expectations and reflects ongoing inflation concerns without altering cryptocurrency market volatility or TradFi-crypto correlations.

ECB Holds Rates Steady for Fourth Meeting

The European Central Bank (ECB)’s Governing Council decided to keep the deposit facility rate at 2% during its December 18 meeting, led by President Christine Lagarde. This marks the fourth consecutive meeting of unchanged rates, following the June 2025 rate cut amid service inflation concerns.

Cryptocurrency markets anticipated the ECB’s move, mirrored by Polymarket predictions, which showed a high probability of no change. Rates remain at 2.15% for refinancing and 2.40% for lending, minimizing yield competition with digital assets.

No major reactions from cryptocurrency leaders were noted immediately following the ECB’s decision. The stability aligns with market pricing indicators, causing BTC and ETH to maintain current trading patterns.

“The ECB’s decision to keep rates steady reflects a cautious approach amid global economic uncertainties,” said a financial analyst.

Steady Eurozone Rates Bolster Crypto Market Stability

Did you know? The ECB’s unchanged rate decision aligns with historical patterns of interest rate stabilization, contributing to steadier trading environments for major cryptocurrencies like Bitcoin and Ethereum.

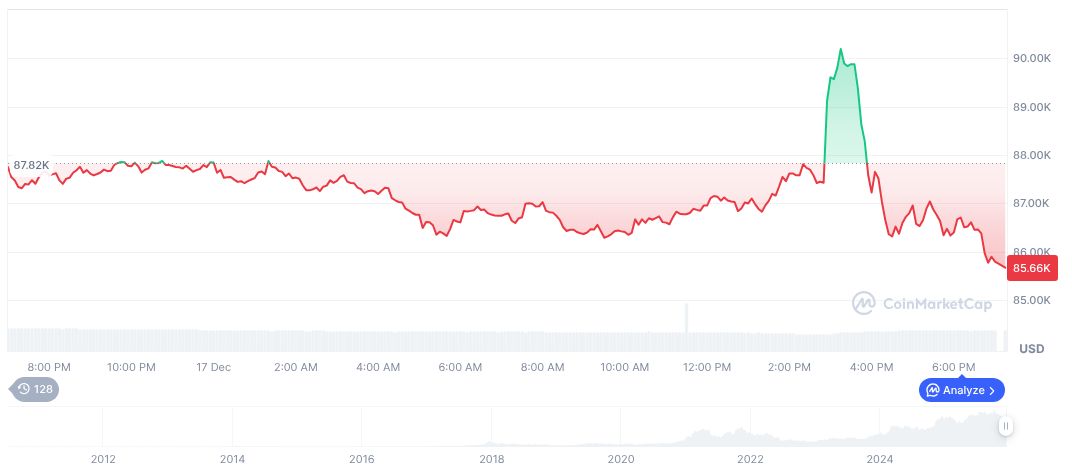

Bitcoin (BTC) currently trades at $88,606.76 with a market cap of $1.77 trillion. According to CoinMarketCap, BTC’s 24-hour trading volume is $45.70 billion, a 1.62% increase in price. Over 60-day and 90-day periods, declines of 17.85% and 23.81% are noted, indicating macroeconomic sensitivity.

Expert insights from Coincu highlight the ECB’s rate decision as neutral for crypto. Historical data suggests ongoing low-rate environments benefit crypto markets by keeping traditional investment returns constrained, potentially steering flows to digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |