- Federal Reserve’s Bullard anticipates more rate cuts in 2026.

- Bitcoin whale moves significant assets amidst expectations.

- Fed’s stance impacts crypto market funding rates.

James Bullard, President of the Federal Reserve Bank of St. Louis, stated in a recent announcement that more rate cuts are expected by 2026 than the current median predictions suggest.

Bullard’s statement indicates potential shifts in economic sentiment, impacting financial markets and cryptocurrencies like BTC, amid evolving views on interest rates and inflation management.

Bullard Foresees 2026 Rate Cuts Amid Inflation Woes

James Bullard, a key figure at the Federal Reserve, has voiced his anticipation of more rate cuts by 2026. His comments come amidst ongoing concerns about inflation and a cooling labor market. Bullard, who has been influential in policy discussions, shared his views during a recent appearance.

The financial landscape is experiencing shifts as investors brace for potential economic adjustments. Notably, a whale transaction involving 5,152 BTC suggests strategic market positioning amid these forecasts. Funding rates are also reportedly seeing a shift from bearish to neutral.

Market reactions highlight increased interest in Bullard’s comments, with asset movements reflecting anticipatory trading behaviors. The crypto community’s response is tempered, and formal statements from regulatory bodies remain absent at this time.

Bitcoin’s Market Dynamics in Light of Fed Policies

Did you know? In past financial cycles, whale Bitcoin (BTC) movements corresponded with Federal Reserve rate cut announcements, often leading to noticeable shifts in market sentiment and trading volumes.

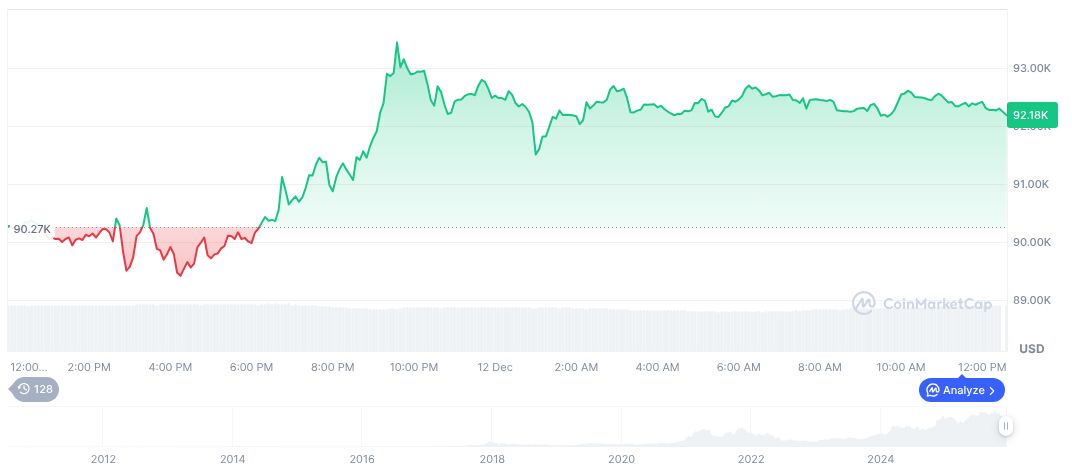

As of December 12, 2025, Bitcoin (BTC) is valued at $92,310.17 with a market cap of $1.84 trillion. Its dominance stands at 58.72%, experiencing a 2.44% increase over the past 24 hours. The coin has seen a 20.06% decrease over 60 days. CoinMarketCap provides this comprehensive data.

Insights from the Coincu research team suggest that potential changes in Federal monetary policy may influence Bitcoin’s stability and value. Historical data indicates that reduced interest rates often correlate with increased crypto market activities. Such periods have at times been marked by price rallies and volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |