Federal Reserve’s Rate Cuts May Affect Cryptocurrency Market

- Varied projections among Federal Reserve officials.

- Impact on cryptocurrency markets.

- Potential shifts in investment strategies.

The Federal Reserve’s 2025 dot plot reveals divided rate cut opinions among officials, with one official forecasting a drastic 150 basis points reduction, according to Jinshi reports.

This rate outlook highlights potential monetary policy shifts, impacting economic landscapes and influencing investment strategies as stakeholders evaluate implications of future rate adjustments by the Federal Reserve.

Federal Reserve 2025 Rate Cut Projections: Divergent Paths

The Federal Reserve’s dot plot indicates differing opinions among officials about the course of interest rate cuts in 2025. Current reports show that while one official predicts no cuts, nine expect a cumulative 75-basis-point reduction, revealing significant divergence in outlooks.

Such financial projections could refer to potential shifts in investment strategies across various sectors. Historically, rate cuts have affected liquidity and risk appetites, impacting economic activities globally.

Despite potential volatility, official declarations or strategic insights from senior figures remain scarce, underscoring the tension across finance and digital spaces.

Cryptocurrency Markets Brace for Fed’s Financial Strategy

Did you know? During major rate shifts, markets often experience increased volatility, as seen in 2023 with the Federal Reserve’s swift changes, highlighting potential gaps or gains for agile crypto strategies today.

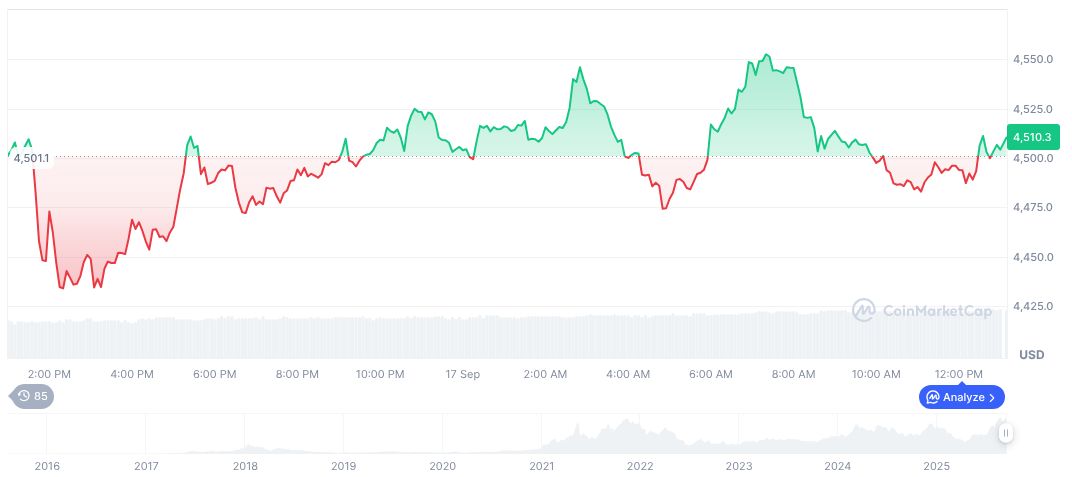

Ethereum’s market capitalization stands at formatNumber(539226222033, 2) dollars, with Ethereum (ETH) trading at $4,467.33. Despite recent fluctuations, Ethereum’s price has risen by 2.84% over the past week, reflective of broader market trends. Data, sourced from CoinMarketCap, underscores Ethereum’s current prominence with its 13.44% market dominance.

Coincu research suggests regulatory uncertainties may amplify the Federal Reserve’s interest rate impact. Cryptocurrencies often demonstrate sensitivity to broadened monetary policy changes, threading opportunities for strategic responses.

“Powerful tools more accessible for blockchain startups” — Pan Yubo, Co-founder, ChainCatcher – ChainCatcher Official Communique

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |