- Federal Reserve lowers interest rates by 25 basis points.

- Market closely eyes Powell’s press conference comments.

- Crypto market response uncertain amid traditional asset trends.

The U.S. Federal Reserve is anticipated to initiate a 25 basis point rate cut today, shifting its target range to 4.00–4.25% amid investor focus on economic signals.

Investors eye possible impacts on cryptocurrencies, as enhanced liquidity could potentially narrow the performance gap between crypto assets and traditional markets.

Federal Reserve Initiates 25 Basis Point Rate Cut

The Federal Reserve has implemented a 25 basis point interest rate cut, adjusting the target range to 4.00–4.25%. Chair Jerome Powell’s communication strategy remains a focal point, as stakeholders seek insights into future policies. Preceding this decision, market participants anticipated a broader rate-cutting cycle extending through 2026.

The interest rate change could affect institutional capital allocation and risk appetite across asset categories, including equities and cryptocurrencies. While improved liquidity is expected, crypto investments have underperformed compared to traditional risk assets, indicating cautious sentiment.

President Donald Trump’s previous remarks pressured Powell for larger cuts, stating, “I think you have a big cut. It’s perfect for cutting.” Without explicit reactions from major crypto leaders, the focus remains on Powell’s address following the Fed announcement.

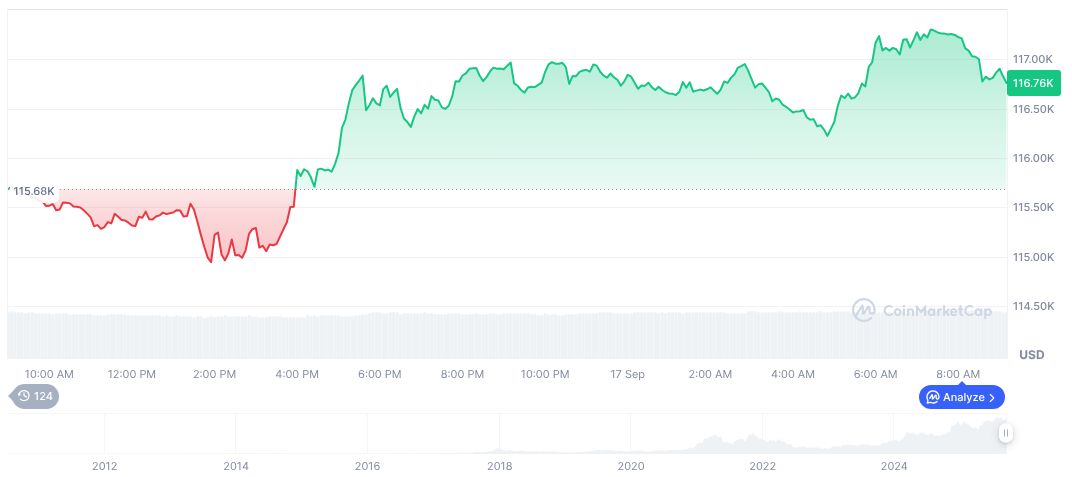

Bitcoin Climbs as Fed Cuts Spark Liquidity Speculation

Did you know? Past interest rate cut cycles, like those in 2019-2020, often resulted in increased cryptocurrency adoption before subsequent volatility. This decision could similarly shape future market trends.

Bitcoin (BTC) prices have reached $116,334.78 as of the latest data from CoinMarketCap. The market cap stands at formatNumber(2317639594057.33,2), with a trading volume of formatNumber(49428133863.48,2). BTC has experienced a 0.79% increase over the past 24 hours, contributing to a 3.60% gain over the last week.

Coincu researchers point out that liquidity improvements might boost crypto transactions, yet regulatory changes and macroeconomic variables could influence longer-term outcomes. BTC’s sensitivity to macro movements remains evident through historical price correlations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |