Federal Reserve Announces Major Rate Cut Amid Diverse Opinions

- Federal Reserve cuts interest rate by 0.5%, differing opinions emerge.

- Markets react to FOMC’s rate cut decision.

- Major cryptocurrencies may face potential volatility.

The Federal Reserve cut interest rates by 0.5% on September 18, 2024, lowering the federal funds rate to 4.75-5%, with dissent from Michelle Bowman.

This decision could increase volatility in cryptocurrencies such as Ethereum and Bitcoin, potentially affecting market dynamics.

Federal Reserve’s 0.5% Rate Cut Spurs Market Analysis

Federal Reserve announced a 0.5% reduction in interest rates, bringing the federal funds rate to 4.75-5%. Jerome Powell and other officials supported this cut, while Michelle Bowman preferred a smaller reduction. This move aims to increase liquidity, yet dissent among officials highlights divisions on the best monetary approach. Market analysts are evaluating the potential for further rate reductions in 2025.

Reactions from key officials remained muted, with no direct statements issued beyond the formal announcement. Bitcoin and Ethereum traders, however, anticipated increased volatility due to this decision, which aligns with historical trends following rate adjustments. Observers suggest that further rate decisions could potentially affect dollar-correlated cryptocurrency valuations.

“The Federal Reserve is committed to achieving its maximum employment and price stability goals.” — Jerome H. Powell, Chair, Federal Reserve, link

Historical Rate Cuts and Crypto Valuations: What to Expect

Did you know? Rate cuts have previously led to significant increases in cryptocurrency valuations, with notable surges observed in 2019 and 2020 as capital flowed into digital asset markets.

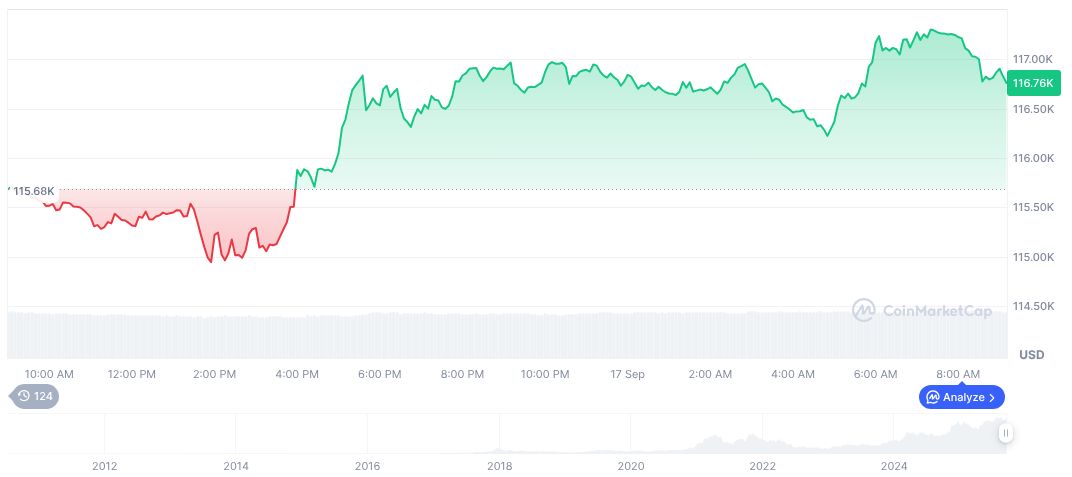

As of September 17, 2025, Bitcoin’s price stood at $115,826.06 with a market cap of $2.31 trillion, reflecting a dominant market position. Recent trading volumes reached $48.67 billion, depicting a dynamic market environment. Price movements over the past 90 days included a notable 11.36% rise, highlighting its recent trajectory. Data sourced from CoinMarketCap.

Coincu research analysts indicate that further federal rate adjustments could influence cryptocurrency valuations, especially for high-liquidity assets like BTC and ETH. Historical trends suggest these decisions can drive capital allocation into risk assets. They emphasize monitoring upcoming policy shifts and their broader economic implications.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |