Federal Reserve Pauses, Affects Cryptocurrency Market Trends

- U.S. unemployment up, Fed pauses, crypto market shifts.

- Federal Reserve holds rates; impacts BTC and ETH.

- Increased volatility in crypto markets prominent in 2026.

The U.S. unemployment rate has increased slightly, leading traders to reduce expectations of upcoming Federal Reserve rate cuts and focus on the likelihood of a pause.

This repricing could impact cryptocurrency markets, with BTC and ETH potentially reacting to changes in macroeconomic conditions influenced by Federal Reserve policy adjustments.

Federal Reserve’s Decision Sparks Portfolio Rebalancing

Recent data from the U.S. Bureau of Labor Statistics indicate a modest increase in unemployment, contrary to earlier assumptions. This shift prompted the Federal Reserve to maintain its interest rates, influencing financial markets and traders’ expectations significantly.

The Federal Reserve’s decision sends a strong signal to markets, emphasizing a “higher for longer” interest rate stance. This has led to traders repositioning their portfolios, expecting fewer cuts than previously anticipated. Such shifts influence both traditional and cryptocurrency markets.

In the crypto community, investors and analysts remain acutely watchful amid the interest rate pause. This alteration in macroeconomic conditions has heightened volatility in cryptocurrencies like Bitcoin and Ethereum, underscored by substantial shifts in derivative positions. Market participants emphasize the importance of these factors.

“Recent releases show the unemployment rate rising modestly from prior lows rather than falling, even as payroll growth stays positive.” – Bureau of Labor Statistics (BLS)

Crypto Volatility Escalates Amid Fed’s Rate Stagnation

Did you know? In previous tightening cycles like 2018-2019, delayed Federal Reserve cuts triggered extended bear markets in cryptocurrencies, similar to what may be observed with current pauses.

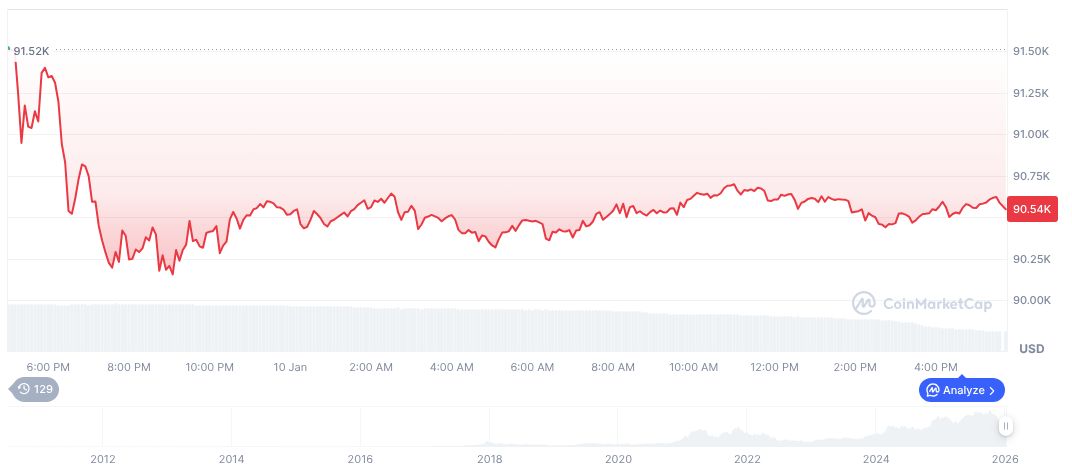

Bitcoin (BTC) currently trades at $90,587.66 with a market cap of 1.81 trillion. Its market dominance stands at 58.44%. Recent trends reveal a 4.25% drop in 24 hours, while it fell by 0.97% over the last 7 days. Historical patterns indicate volatility amid these economic conditions, per CoinMarketCap.

Expert analysis by the Coincu research team suggests potential financial fluctuations in the cryptocurrency sector due to macroeconomic policy adjustments. A focus on governmental decisions remains essential, impacting trading volumes and prices. Evaluation of these metrics provides deeper insight into the market’s current state according to the Federal Reserve interest rate forecast for 2026 explained.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |