- The Federal Reserve reduced the federal funds rate by 0.25%. Economic data holds implications for future decisions.

- The market watches for the upcoming U.S. economic data.

- This rate cut impacts liquidity and market expectations.

The Federal Reserve has reduced the federal funds rate by 25 basis points to 3.50%–3.75%, signaling the third consecutive cut, causing varied reactions in stock and bond markets.

Upcoming U.S. economic data releases, including CPI, could profoundly impact both dollar strength and cryptocurrency market dynamics, affecting Bitcoin and Ethereum trading volumes.

Federal Reserve Cuts Rate Amidst Weak Labor Signals

The Federal Reserve recently reduced the federal funds rate target by 0.25 percentage points during its December meeting. This decision aims to support the economy amidst weaker labor market signals.

Immediate implications include a potential shift in investor sentiment and asset allocation strategies. A reduction in borrowing costs could stimulate spending, affecting liquidity across various markets.

Market reactions to this decision have been mixed, with some investors cautious about future rate adjustments. Fed Chair Jerome Powell emphasized the need to focus on economic data to guide forthcoming policy decisions.

Cryptocurrency Markets Navigate Rate-Cut Impacts

Did you know? Rate-cut cycles historically support risk assets like cryptocurrencies, potentially boosting liquidity and inflows into assets such as Bitcoin during dovish monetary phases.

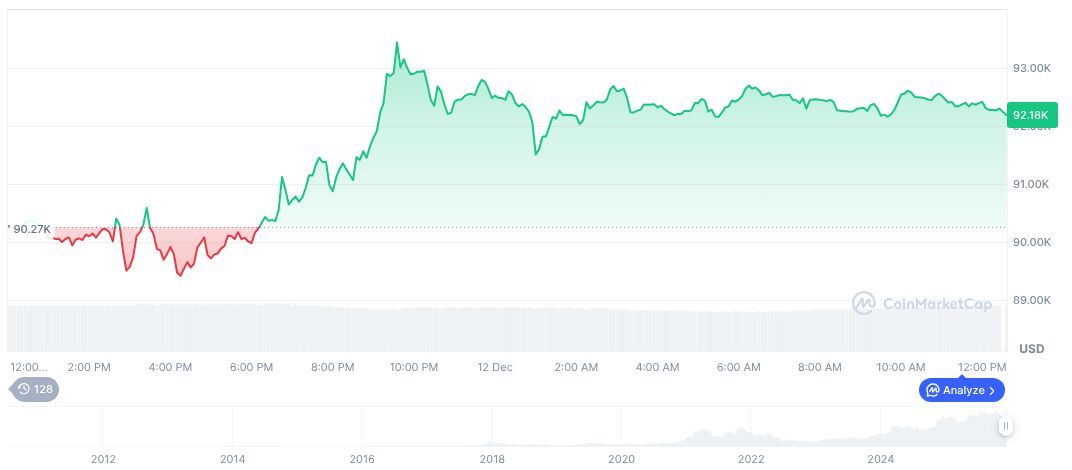

Bitcoin, holding a current price of $90,389.68, exhibits a market cap of approximately $1.80 trillion, according to CoinMarketCap. With a circulating supply of 19,961,596 BTC, the cryptocurrency is navigating market fluctuations, registering a 24-hour trading volume of around $81.86 billion, reflecting a 23.20% change. Recent price changes over 30 and 60 days include declines of 12.26% and 18.84%, respectively.

Insights from Coincu research team suggest that the rate cut may foster a more favorable environment for cryptocurrencies, aligning interest in technological developments and possibly advancing regulatory frameworks. The evolving landscape requires vigilant analysis of economic signals.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |