Federal Reserve Interest Rate Decision Anticipated Amid Market Shifts

- The Federal Reserve to decide on a potential interest rate cut.

- Anticipation of a 25 basis point reduction.

- Dissent exists within FOMC, impacting financial projections.

The Federal Reserve is poised to announce its interest rate decision at 03:00 on Thursday, potentially cutting rates by 25 basis points amidst internal FOMC disagreements.

The anticipated rate cut focuses investor attention on liquidity shifts, including a possible Reserve Management Purchase Program, influencing both traditional and crypto financial markets.

Federal Reserve’s Interest Rate Cut: A 25 Basis Point Debate

The Federal Reserve is expected to announce an interest rate cut of 25 basis points to 3.50%-3.75%. This anticipated decision comes amidst rare disagreements within the Federal Open Market Committee. Some voting members may oppose further rate cuts, signaling potential shifts in monetary policy dynamics.

Market speculation focuses on liquidity adjustments. The Federal Reserve might introduce a “Reserve Management Purchase Program” after halting balance sheet reduction. Analysts project purchases of about $45 billion in short-term U.S. Treasuries, potentially increasing to $60 billion if Mortgage-Backed Securities reinvestments are included.

“With the Federal Reserve’s expected interest rate cut, the impacts on crypto liquidity and asset valuations are likely to intensify, especially amid changing investment landscapes toward Ethereum and Solana.” — Economist, Market Strategist

Ethereum’s Market Reaction to Fed’s Liquidity Moves

Did you know? Historical alterations in the Federal Reserve’s liquidity programs have consistently led to shifts in crypto market dynamics, often elevating asset volatility during key policy changes.

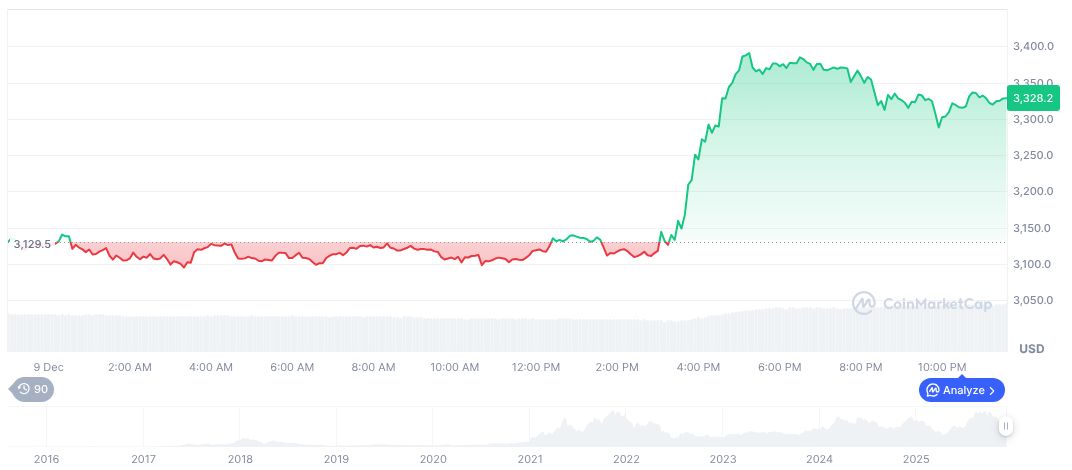

Ethereum (ETH) is trading at $3,324.89 with a market cap of $401,297,770,354. It dominates 12.78% of the market according to CoinMarketCap. With a 24-hour trading volume of $33,626,839,360, ETH noted a 5.97% price hike in the last 24 hours but is down 24.85% over the past 90 days.

Coincu analysts highlight the importance of Fed liquidity policies influencing crypto markets. These shifts could impact financial, regulatory, and technological landscapes. Cautious market behavior is expected as investors watch for potential opportunities in emergent monetary strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |