- FedWatch predicts 73.4% chance of unchanged rates in January.

- Interest rate cuts unlikely, market remains steady.

- Stable rates affect Bitcoin, Ethereum market speculation.

CME’s “FedWatch” data indicates a 26.6% probability of a 25 basis point Fed rate cut in January 2024, with a 73.4% chance rates remain unchanged.

While no direct cryptocurrency impact report exists, market speculation includes potential effects on BTC and ETH amid this Fed rate cut probability.

73.4% Rate Stability: Crypto Market Reactions

The CME Group’s recent data release forecasts a 73.4% probability that the Federal Reserve will maintain current interest rates in January 2026. Meanwhile, an alternative scenario where rates are reduced by 25 basis points holds a 26.6% likelihood. Interest rate speculation affects multiple financial markets, including cryptocurrencies.

Maintaining interest rates at current levels implies that market conditions remain stable, which often results in lower volatility for digital assets. This stability is particularly relevant for major cryptocurrencies like Bitcoin and Ethereum, which typically respond to economic policy shifts.

Industry leaders and market analysts are closely monitoring these projections. Despite some optimism from figures such as Brian Armstrong, CEO of Coinbase, specific comments on this particular probability estimate are sparse. Armstrong notes, “I have seen many positive developments since my last visit. We hope the CLARITY Act will be submitted for presidential signing soon,” highlighting the ongoing regulatory context (source). Regulatory clarity remains a crucial factor for future market developments.

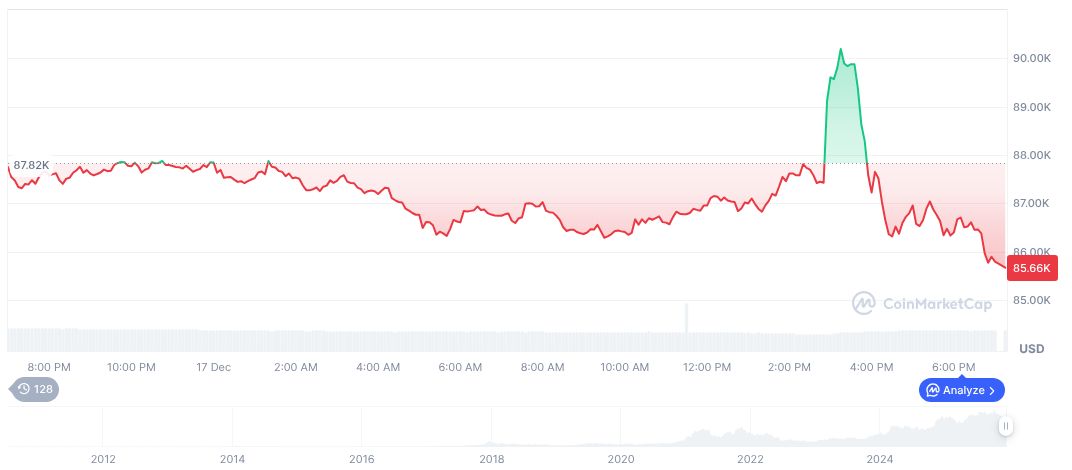

Bitcoin’s Market Cap Reaction to Fed Speculation

Did you know? Monetary policy shifts often ripple through markets, influencing asset valuations. Bitcoin responded notably to past rate adjustments, adding historical relevance to current market conditions.

Bitcoin, trading at $86,563.22, reflects a market cap of $1.73 trillion. Recent declines include -0.10% over 24 hours and -25.31% over 90 days. Its market dominance is at 58.67%, with a trading volume of $43.13 billion. Data sourced from CoinMarketCap indicates interest rate effects.

Coincu’s research team notes that consistent interest rate projections could facilitate long-term planning for institutional investors in the crypto space. This stability fosters an environment less susceptible to speculative spikes or dramatic market swings. The ongoing macroeconomic policy influences remain a critical component of cryptocurrency market dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |