- Garrett Jin’s strategic BTC sale and ETH acquisition impact crypto markets.

- Whale activity redirected billions, influencing broader market trends.

- Expert analysis cautions liquidity risks amid high-leverage positions.

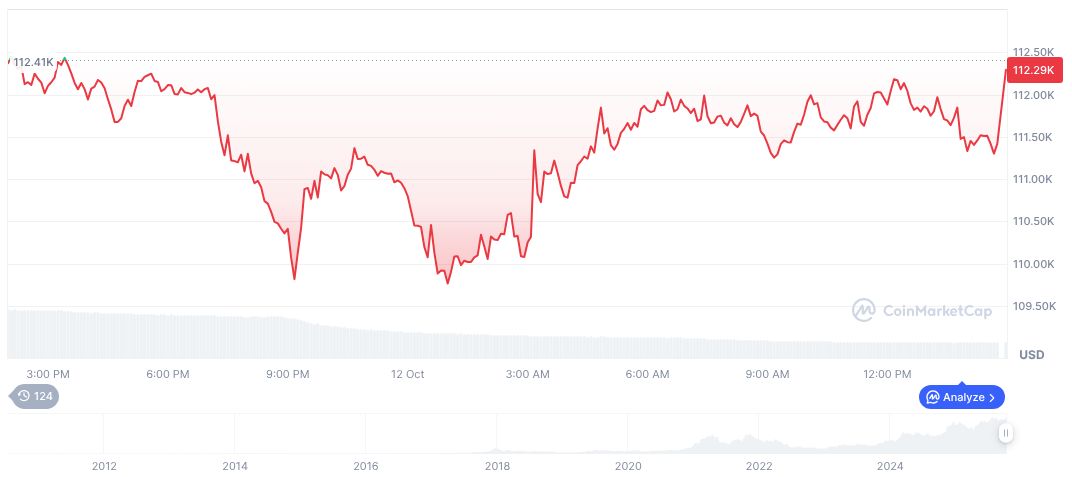

On October 13th, Whale Garrett Jin, previously infamous for selling $4.23 billion worth of BTC, elucidated his bearish stance before the October 11th cryptocurrency crash, citing market overbought signals.

Jin’s significant switch from BTC to ETH underscores the influence of high-profile investors and highlights the intertwining risks in tech stocks and cryptocurrency markets, affecting market sentiment and liquidity.

Garrett Jin’s $4.23 Billion Crypto Transition

Garrett Jin, a former BitForex CEO, executed a substantial crypto market shift by selling over $4.23 billion worth of Bitcoin and moving funds into Ethereum. Prior to this move, Jin emphasized the overbought signals in both cryptocurrencies and U.S. tech stocks, indicating a shifting risk landscape.

The implications of these actions are extensive. Jin’s perspective pointed to ongoing market structural instability exacerbated by high-leverage positions in cryptocurrencies. The event highlights how trading platforms offering aggressive leverage to retail investors could face a liquidity crisis analogous to past market downturns.

Statements by key figures like Changpeng Zhao (CZ) of Binance reveal industry concern. Garrett Jin, Former CEO, BitForex, said, “Thank you Changpeng Zhao for sharing my personal information. To clarify, I have no relationship with the Trump family or Trump Jr. – this is not insider trading. The funds are not mine, but my clients’.” Certain analysts question his motivations, sparking discussions on market stability and regulatory oversight.

Cryptocurrency Market Correlations and Insights

Did you know? The cryptocurrency market often mirrors tech stock trends, as evidenced by significant investor actions like Jin’s recent move. Such correlations have precipitated prior downturns, notably the 2015 A-share and March 2020 U.S. stock market crashes.

As of October 13, 2025, Bitcoin (BTC) is priced at $115,256.40, with a market cap of approximately $2.30 trillion, according to CoinMarketCap. Trades in the last 24 hours reached roughly $93.44 billion, marking a 30.07% increase. BTC prices saw a 3.13% rise over 24 hours, despite a 7.01% decrease over a week.

The Coincu research team indicates lingering liquidity concerns due to aggressive leverage offerings in the market. Structurally, the market remains prone to external shocks, as macro factors and high-profile transactions like Jin’s exacerbate inherent volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |