Trump’s Fed Chair Candidates Spark Market Debate: Hassett vs. Warsh

- Kevin Hassett and Kevin Warsh are leading candidates for Trump’s Fed Chair selection.

- Discussions influence financial predictions, impacting Hassett’s potential and Warsh’s rise.

- Expert signals bolster Warsh’s standing; market reflects this shift.

Kevin Hassett’s potential Federal Reserve Chair candidacy faced scrutiny after concerns arose over his close ties to former President Trump, altering market predictions for leadership selection.

These shifts signify potential impacts on monetary policy preferences, affecting prediction markets and investor sentiment, with Kevin Warsh emerging as a significant contender.

Hassett and Warsh: Market Impacts and Forecasts

Kevin Hassett and Kevin Warsh are the main candidates for the Federal Reserve Chair role, as scrutinized by Trump. This scrutiny outlines Hassett’s close ties to Trump, initially favoring his candidacy. Warsh, supported by some market players, has gained momentum recently. Interviews for the position were previously paused, highlighting internal deliberations.

The probability of Hassett securing the role has decreased from 80% to 51% on prediction platforms like Kalshi, while Warsh has surged to 44%. Market watchers indicate a strong preference shift towards Warsh, suggesting potential U.S. economic and monetary policy recalibrations under his tenure.

JPMorgan Chase’s CEO Jamie Dimon expressed positive remarks about both candidates, yet hinted a preference towards Warsh, reflecting a broader market sentiment shift. Experts note that these public endorsements can sway opinion and affect both candidates’ standings.

Historical Context and Expert Predictions

Did you know? The debate over Fed leadership mirrors Trump’s 2017 decision, where Warsh was favored but eventually passed over for Jerome Powell instead. Such decisions have historically signaled shifts in monetary policies and influenced financial markets significantly.

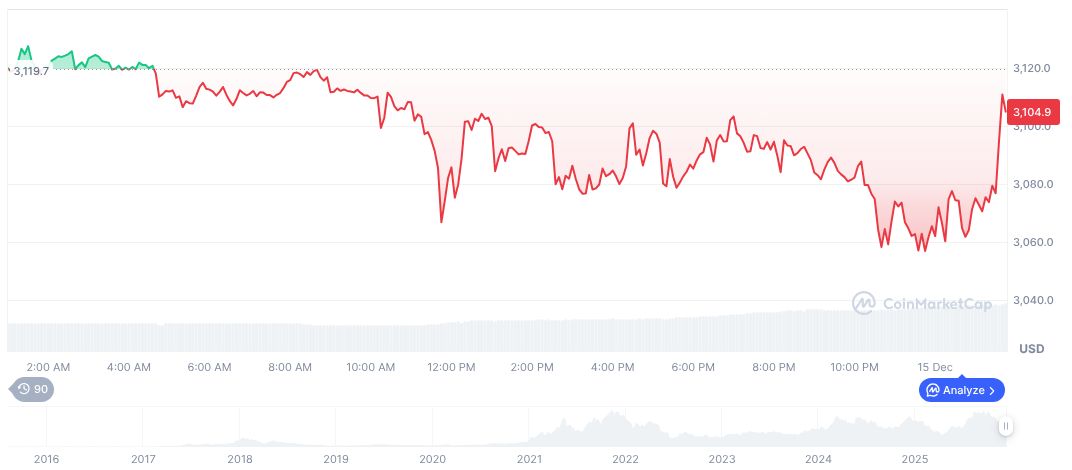

Ethereum (ETH) data presents notable market movements. Currently priced at $2,988.87, with a market cap of $360.74 billion, it shows a trading volume of $24.67 billion, indicating a high transactional interest. These figures are attributed to recent volatility and market conditions reported by CoinMarketCap.

The Coincu research team predicts a possible regulatory and financial realignment if Warsh is appointed. Historical trends imply a more conservative approach to monetary expansion could follow, potentially stabilizing long-term financial outlooks while curbing immediate market exuberance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |