Conflicting Forecasts on Fed Rate Moves in 2026–2027 by JPMorgan

- JPMorgan’s Fed rate forecasts for 2026–2027 show conflicting expectations.

- Market responses uncertain amid forecast discrepancies.

- Potential impact on rate-sensitive assets like crypto.

JPMorgan’s Fed rate forecast claims suggest no cuts in 2026 and a 25-point hike in Q3 2027, though official sources contradict these predictions.

This claim, lacking primary confirmation, influences crypto markets, affecting assets sensitive to rate expectations like BTC and ETH.

Contradictory Fed Forecasts Leave Markets Uncertain

JPMorgan’s recent forecast, indicating no rate cuts in 2026 with a rate hike in Q3 2027, has been challenged. Experts and strategists have pointed out discrepancies, as primary source documents from JPMorgan still predict two rate cuts in 2026 and additional easing in 2027. Reports contrasting with official projections create uncertainty in financial circles.

Market participants are adjusting their strategies amidst these conflicting forecasts. While some investors brace for tighter monetary conditions, many continue to align with forecasts of rate cuts. Official sources suggest accommodating policy intent, contrasting with recent external reports suggesting otherwise.

David Kelly, Chief Global Strategist, J.P. Morgan Asset Management, said, “With no real recession threat, elevated inflation in the near term and the prospect of further fiscal stimulus, we expect the Federal Reserve to take its time in implementing further rate cuts with two in total in 2026 and a further cut in 2027.”

Bitcoin and Market Strategies in a Shifting Macro Environment

Did you know? In recent history, discrepancies in forecasts like this have led to significant adjustments in market expectations, highlighting the pivotal role of accurate communication in financial predictions.

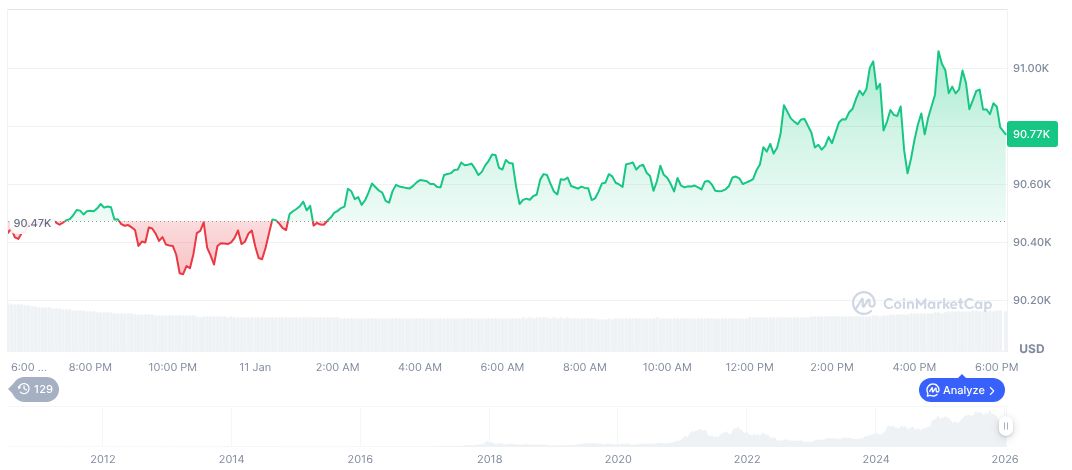

Bitcoin (BTC) is currently valued at $91,749.14, according to CoinMarketCap. With a market cap of over $1.83 trillion and a 58.54% market dominance, it remains a leader in the crypto sphere. The 24-hour trading volume surged by 111.49%, reflecting the cryptocurrency’s dynamic nature. Recent performance indicates mixed trends, with BTC up 1.33% over the past 24 hours but down 18.16% over 90 days.

Coincu researchers highlight potential shifts in macroeconomic strategy in financial sectors amid inconsistent predictions. Regulatory prudence and technological advancements may provide new pathways, underscoring the importance of accurate data. Investors look to historical trends for predictive insights, emphasizing the significance of transparent macroeconomic forecasts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |