- Kevin Hassett’s nomination probability for Fed Chair surged to 35%.

- Hassett’s pro-rate cut stance aligns with President Trump’s goals.

- An announcement on Fed Chair selection is expected before Christmas.

Kevin Hassett’s candidacy for Federal Reserve Chair has surged, with his probability increasing from 14.2% to 35% in recent prediction markets, signaling strong White House support.

Hassett’s potential appointment aligns with Trump’s dovish economic directive, potentially impacting interest rates, broader financial markets, and cryptocurrencies by fostering a more accommodative monetary policy.

Hassett’s Rise and Market Implications

Kevin Hassett’s nomination probability to become the next Federal Reserve Chair has increased to 35%, making him the top favorite in the prediction market. The surge reflects his reputation as a steadfast advocate of interest rate cuts.

Hassett’s alignment with Trump’s pro-rate cut agenda is a primary reason for the market optimism surrounding his potential appointment. This shift could lead to significant easing in monetary policy.

Market observers have been quick to react, assessing the implications of a dovish Fed Chair. Treasury Secretary Scott Bessent confirmed the narrowing of candidates, which has further fueled speculation.

Crypto Sector Eyes Potential Fed Policy Shift

Did you know? In past instances, a dovish Federal Reserve Chair has often led to increased liquidity in financial markets, a scenario beneficial for risk assets like cryptocurrencies, highlighting the importance of potential leadership changes.

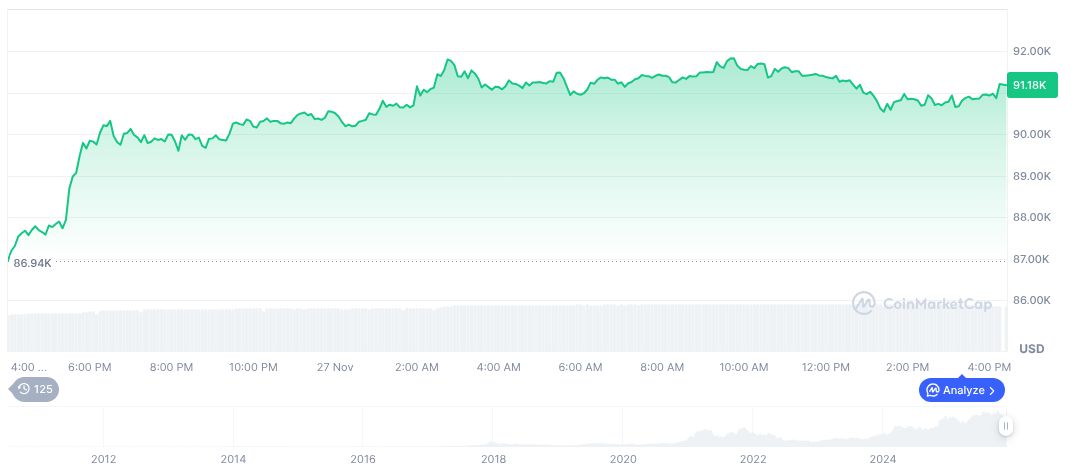

Bitcoin (BTC) stands at $91,371.66, supported by a market cap of $1.82 trillion and 24-hour trading volume of $49.44 billion (-31.38%). In the last week, BTC rose 6.70%, though it shows a 19.18% decline over 30 days, per CoinMarketCap data.

Experts from Coincu suggest that Hassett’s nomination could support a potential relaxation in policy, fostering a more supportive environment for cryptocurrency investments. This aligns with historical patterns of rate cuts boosting asset prices.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |