MicroStrategy Retains Nasdaq 100 Slot Amid MSCI Rule Concerns

- MicroStrategy retains Nasdaq 100; MSCI rules may affect future.

- Potential forced stock sales could reach 2.8 billion dollars.

- Company advocates as operating entity, not crypto holder.

MicroStrategy, led by Executive Chairman Michael Saylor, retains its Nasdaq 100 position amidst MSCI’s potential exclusion due to significant crypto holdings, impacting their stock prices and index funds.

This exclusion could compel passive funds to sell $2.80 billion of MicroStrategy stock, posing significant market impacts for top crypto asset BTC, their main treasury holding.

MicroStrategy Fights MSCI Rules Amid $2.8B Potential Impact

MicroStrategy’s continued presence in the Nasdaq 100 demonstrates its stability amid regulatory scrutiny. Company executives are actively opposing MSCI’s prospective rule changes, aiming to protect their index inclusion. They emphasize that MicroStrategy functions as an operating software company, not merely a crypto holder.

MSCI’s proposal could lead to significant capital shifts, potentially forcing funds to divest $2.8 billion if the rules exclude firms with large crypto holdings. If enacted by January, this could critically impact MicroStrategy’s NASDAQ position and investor sentiment.

Market and community reactions include scrutiny of MicroStrategy’s strategy. Public statements from leadership stress the firm’s operational credibility. While some analysts raise concerns, others speculate on long-term strategic adjustments.

Bitcoin Trends and Strategic Implications for MicroStrategy

Did you know? MicroStrategy was the first major company to adopt Bitcoin as a primary treasury asset, pioneering a trend for other corporate entities.

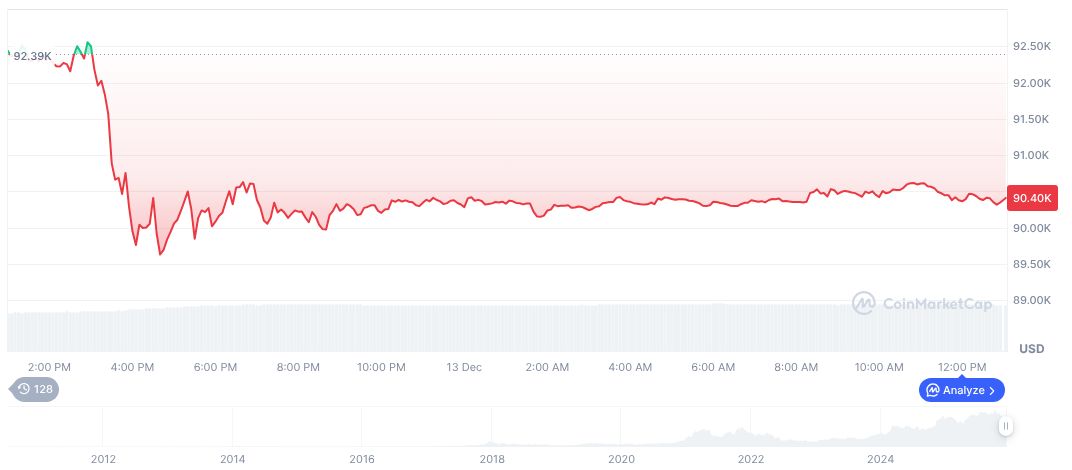

According to CoinMarketCap, Bitcoin currently trades at $90,240.46 with a market cap of $1.80 trillion. Recent data shows a 2.24% drop over 24 hours, a slight 7-day increase of 0.61%, and a 12.04% fall over 30 days, indicating volatile market conditions.

Insights from the Coincu research team highlight potential regulatory challenges MicroStrategy faces if MSCI’s rules take effect. Analysts suggest long-term strategic CEO decisions could impact the broader crypto sector’s integration with traditional markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |