- Fed Chair Jerome Powell reinforces the 2% inflation target.

- Markets, including crypto, adapt to macroeconomic policy changes.

- Historical context links Fed policy statements to crypto movements.

Federal Reserve Chairman Jerome Powell emphasized a continued commitment to achieving a 2% inflation target in recent remarks, underscoring ongoing efforts in economic policy management.

Powell’s reaffirmation could influence crypto market dynamics, prompting investor focus on Bitcoin and Ethereum amid potential shifts in monetary policy.

Powell’s Inflation Target and Its Crypto Market Influence

Powell’s statement creates potential shifts in financial market dynamics, particularly in asset allocation and interest rates. Cryptocurrency markets, sensitive to such macroeconomic policies, might see varied responses as investors adjust risk exposures. Powell’s monetary stance could influence capital deployment across digital and traditional financial sectors. As Powell stated, “We need to continue to fully commit to restoring the 2% inflation target.”

Major economic and market forums closely follow these developments, with analysts examining potential impacts across sectors. Li-market responses include discussions on financial stability and crypto sector adaptability. Economic expert observations suggest attention to further policy updates, though immediate on-chain cryptocurrency reactions remain unreported as of now.

Did you know? Historically, Powell’s speeches on inflation have triggered notable crypto market moves, reflecting their sensitivity to macroeconomic cues from U.S. monetary policy.

Historical Context, Price Data, and Expert Analysis

Did you know? Historically, Powell’s speeches on inflation have triggered notable crypto market moves, reflecting their sensitivity to macroeconomic cues from U.S. monetary policy.

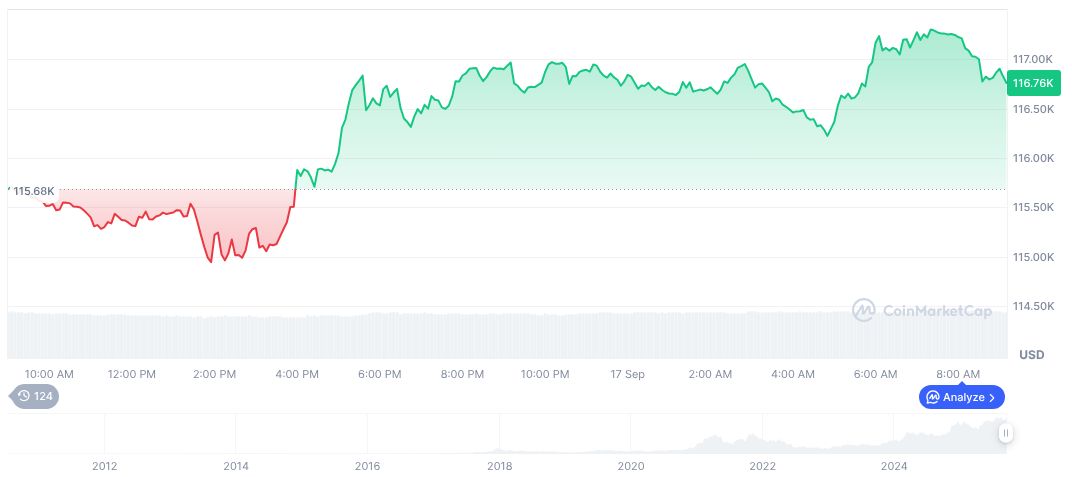

Bitcoin (BTC) remains a central player in cryptocurrency markets, currently priced at $115,556.80, with a market cap of $2,302,155,127,478.22. BTC leads with a market dominance of 57.48%, trading $52,419,528,067.73 in the last 24 hours, a 21.58% increase, reported by CoinMarketCap.

Coincu research indicates potential regulatory and financial trends may result from Powell’s statements, impacting digital asset allocation strategies. Analyzing historical market precedents, experts note the historic sensitivity of BTC and ETH to Fed policies, although current data show no unusual movements post-announcement. Fed rate cut impacts could offer insights into further financial adjustments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |