Federal Reserve Chair Powell Validates Rate Cut in September

- Powell’s statement validates September rate cut rationale.

- Key crypto market shifts observed.

- Institutional stakeholders and analysts react.

Federal Reserve Chairman Jerome Powell cited increasing risks in the job market to justify the rationale for a potential rate cut in September, impacting cryptocurrency market dynamics.

This statement could alter cryptocurrency flows, affecting asset liquidity and influencing investor risk preferences, as observed by analysts and institutional stakeholders.

Federal Reserve Chair Powell Validates Rate Cut in September

Federal Reserve Chairman Jerome Powell’s recent statement emphasized increasing risks in the job market, validating the decision for a potential rate cut in September. As confirmed by Jinshi reports, Powell asserted these consequences during a publicly disclosed speech.

As Powell noted, “As labor market risks have increased, the rationale for considering a rate cut in September has strengthened.” More details can be found on FederalReserve.gov.

Market participants and influencers have shared their reactions, with on-chain investigator ZachXBT noting:

These events have triggered conversations about transparency and security within the crypto ecosystem.

Regulatory Recalibrations Linked to Federal Reserve’s Decision

Did you know? Historical data shows that Federal Reserve policy changes, such as those in March 2020 and July 2023, often correlate with notable whale activity and reconsidered risk strategies in the cryptocurrency market.

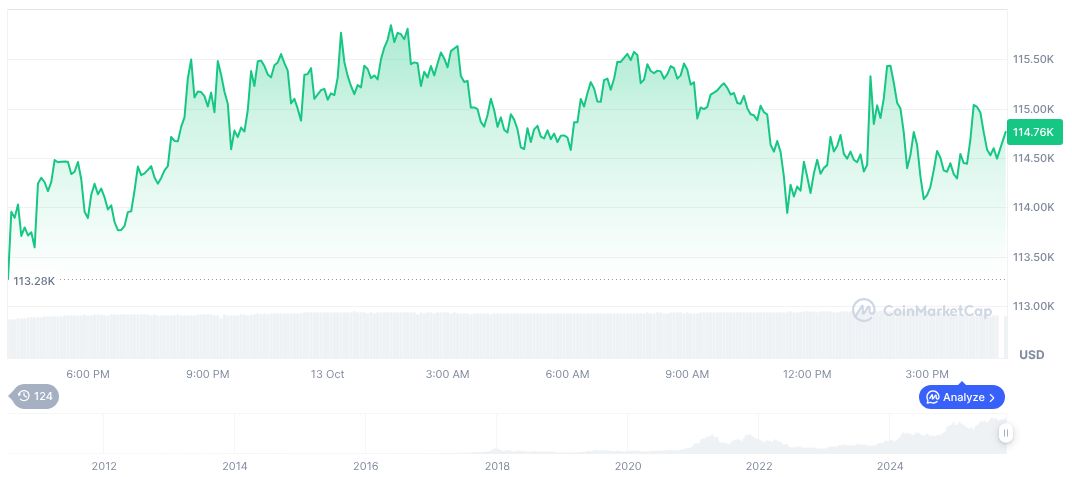

Bitcoin (BTC) is trading at $112,818.95 with a market cap of $2.25 trillion and a dominance of 58.59% as reported by CoinMarketCap. Over the last 24 hours, BTC has seen a -1.69% decrease, whereas its 7-day change stands at -6.81%. The circulating supply is nearing its max at 19,934,406 BTC.

From a broader perspective, insights from CoinCu’s research indicate potential regulatory recalibrations with Powell’s rate cut decision. Such adjustments could alter institutional investment trajectories, highlighting the importance of incorporating market resilience and advanced allocation strategies amidst shifting fiscal policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |