- S&P 500 sets an intraday record amid buyback surge.

- Buybacks forecasted at $1.9 trillion by 2025.

- Equity supply shrinkage supports ongoing market growth.

On September 11, the S&P 500 index hit a new intraday record, with U.S. stock buybacks reaching an unprecedented $1.5 trillion, according to data from JPMorgan Chase.

This buyback surge indicates ongoing market support despite low IPO activity, potentially influencing broader asset classes including cryptocurrencies if equity trends persist.

Buybacks to Reach $1.9 Trillion, Supporting Market Growth

JPMorgan Chase’s forecast estimates a substantial rise in stock buybacks, boosting the global scale to $1.9 trillion by 2025. Sustained equity buybacks suggest pricing support due to the scarcity of available stocks, despite the dip in IPO activity. Market dynamics also depict a continued backing from reduced share availability, positively impacting overall market health.

Global buyback volumes have reportedly surged, continuing a trend of market buoyancy as the S&P 500 reaches peak levels. Equity scarcity may prompt shifts in capital allocation, potentially benefiting high-risk assets if buybacks maintain their current pace.

Market commentators and analysts underline the importance of the buyback phenomenon. Significant voices in finance are observing this trend, underscoring how stock shortages can sustain price levels. Larry Fink, CEO of BlackRock, has reiterated the role of buybacks in reducing market volatility. “Markets tend to chase performance — when equities surge on buybacks, capital often trickles into crypto next.”* — Raoul Pal, CEO, Real Vision

Implications of Buybacks on Market Stability and Asset Valuation

Did you know? Compared to the 5% buyback rate in 2007, today’s figures still demonstrate lesser intensity. However, the rising stock constraint will likely continue its influence on long-term market strategies.

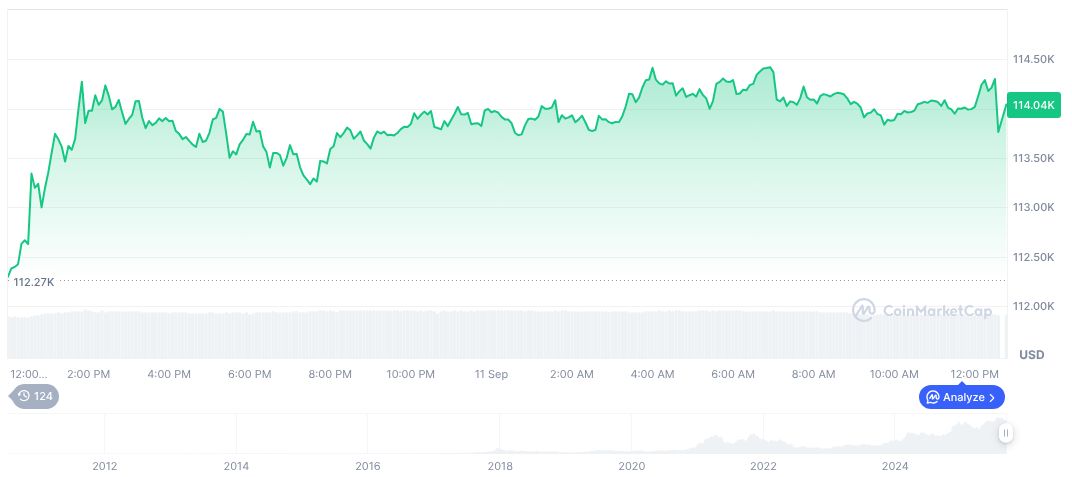

As of September 11, the Bitcoin value stands at $114,287.97, reflecting a 9.27% rise over 90 days. Market cap is approximately $2.28 trillion, according to CoinMarketCap. Despite fluctuations, a consistent market position prevails.

According to the Coincu research team, sustained stock buyback activities can potentially lead to elevated financial market resilience, albeit under strict regulatory scrutiny. Should this trend continue, its effect on the cryptocurrency sector, particularly Bitcoin and Ethereum, could manifest in increased investment flow and asset valuation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |