Spot Gold Reaches All-Time High Amid Fed Rate Cut Speculation

- Spot gold reaches new highs due to rate cut expectations.

- Gold price climbs nearly $400 since August.

- No immediate reaction from major crypto figures reported.

Spot gold surged to just below $3,700 on September 16, influenced by expected U.S. Federal Reserve rate cuts and increased global central bank purchases.

The rise impacts both traditional and digital markets, highlighting its continued relevance as a safe-haven asset amid macroeconomic shifts.

Spot Gold’s Historic Surge Sparks Broader Economic Impact

Gold prices have seen a rapid increase since August 20, rising nearly $400. The anticipated actions by the Federal Reserve have spearheaded this surge, as market participants brace for possible rate cuts aimed at stimulating the economy. Central banks globally have amplified their gold purchases, with Q2 purchases 41% above historical norms.

The implications of this event extend beyond traditional markets. Crypto investors often view gold and Bitcoin (BTC) as alternative or complementary assets during economic uncertainty. Although no official statements have been made by leaders in the cryptocurrency industry, historical patterns suggest possible increases in BTC demand as a hedge against economic shifts.

Jerome Powell, Chair, Federal Reserve, said, “Market sentiments indicate a strong likelihood of rate cuts which may continue to influence precious metals.”

Crypto Market Poised for Potential Shifts Amid Rate Cut Expectations

Did you know? Spot gold prices soared during past Federal Reserve rate cut periods, mirroring spikes in Bitcoin demand as investors sought alternatives due to dollar weakness.

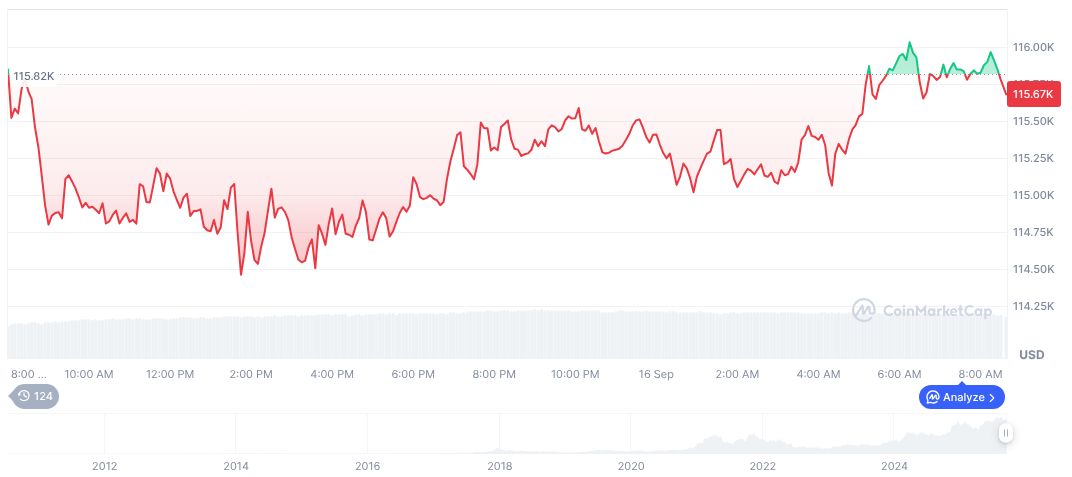

Bitcoin’s current price stands at $115,069.14 with a market capitalization of $2.29 trillion, as per CoinMarketCap. Despite slight fluctuations, including a 0.22% rise in 24 hours and a 3.12% increase over the past week, BTC’s market dominance remains robust at 57.52%.

Analysts from Coincu suggest potential shifts in crypto markets as macroeconomic policies evolve. The anticipated Fed rate cuts could lead investors toward Bitcoin as a hedge, with technological and regulatory changes possibly supporting broader crypto adoption.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |