Stablecoin Market Cap Surpasses 310 Billion USD Amid Institutional Flows

- Stablecoin market cap exceeds 310 billion USD, reflecting institutional capital realignment.

- 10 billion USD influx observed in three weeks

- Significant shifts in DeFi and traditional market products

The total market capitalization of stablecoins has surpassed $310 billion, setting a new historical high, as reported by ChainCatcher, driven by significant institutional inflows.

This milestone indicates a notable shift in institutional crypto dynamics, with major implications for cross-chain liquidity and DeFi markets.

Stablecoin Market Surges with 10 Billion USD Increase

The stablecoin market, led by Tether (USDT) at 179.969 billion USD, recently surpassed 310 billion USD, marking about a 10 billion USD increase in three weeks. This milestone highlights broad institutional investment shifts amid liquidity moves in the crypto sector.

Increased stablecoin use supports cross-chain liquidity and DeFi TVL, while major outflows from Ethereum-centric products like ETH ETFs show a realignment towards stablecoins. Crypto assets such as ETH and SOL reflect market adjustments amid DeFi TVL growth and cross-chain activity.

The Opyn team has been dedicated to building in the DeFi space from the early days; they are the developers of the first DeFi options protocol…This team possesses deep on-chain technical expertise, a profound understanding of traditional market structures, and practical experience in building decentralized products from the ground up, which is quite rare in the industry. — Coinbase Official Statement, Onchain Markets Team, Coinbase

Institutional Influence and DeFi Role in Crypto Growth

Did you know? The stablecoin market’s rapid growth echoes past crypto-conference trends, where industry gatherings often precede substantial liquidity and strategic realignments.

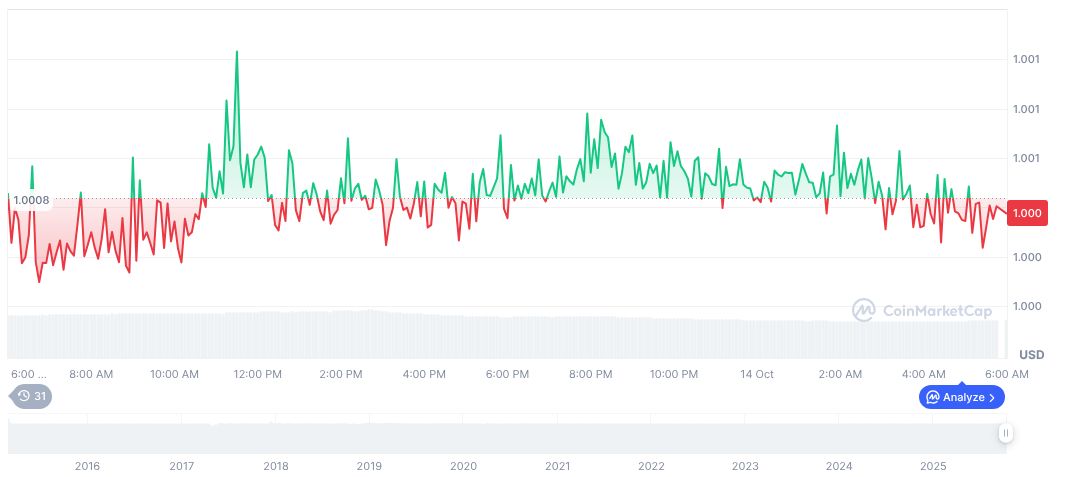

Tether (USDT) currently has a market cap of 180.19 billion USD and trades at $1.00, maintaining a market dominance of 4.78%. Recent price changes remain steady, while trading volume hit 203.80 billion USD, per CoinMarketCap, showing a 11.45% decrease in 24 hours.

Research by Coincu suggests potential financial growth in crypto due to shifts in liquidity and regulatory focus. Experts highlight DeFi’s growing role and the need for enhanced compliance strategies as crucial for ecosystem evolution.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |