- Trump demands Fed Chair Powell to cut interest rates, citing no inflation.

- Calls add pressure on financial markets.

- Potential impacts on crypto market volatility.

On September 10, former U.S. President Donald Trump criticized Federal Reserve Chair Jerome Powell on Truth Social, demanding immediate interest rate cuts and dismissing inflation concerns.

Trump’s comments intensified market speculation on potential rate cuts, affecting investor sentiment toward risk assets like cryptocurrencies, as lower rates typically boost demand for such investments.

Crypto Market Volatility Likely as Rate Speculation Grows

Powell must substantially reduce interest rates and act immediately. No inflation! Powell is a disaster, he understands nothing!

quote text

Powell must substantially reduce interest rates and act immediately. No inflation! Powell is a disaster, he understands nothing!

Market Data and Insights

Did you know? Historical precedents show that announcements regarding Federal Reserve rate reductions have often triggered significant movements in Bitcoin, ETH, and other major cryptos, reflecting investors’ search for return on investment during prior low-rate periods.

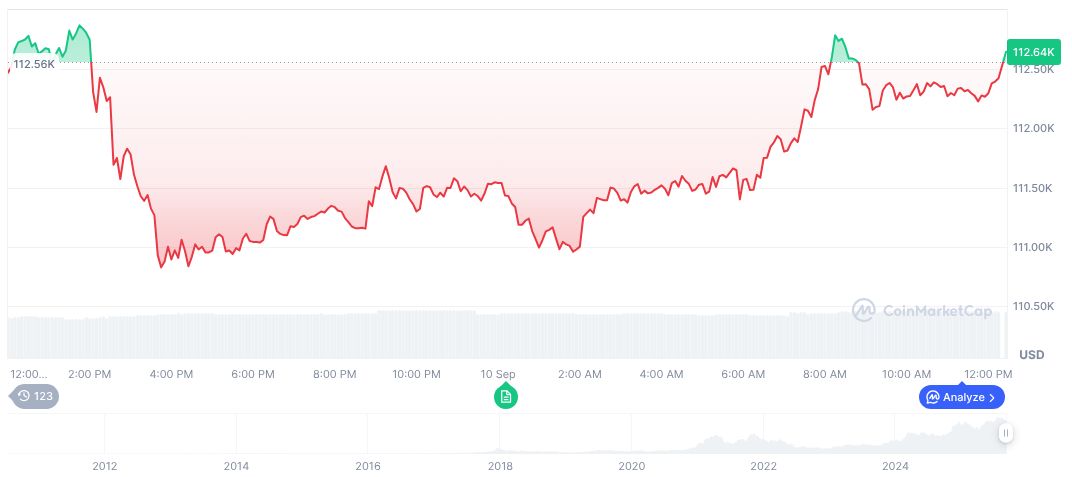

CoinMarketCap reports Bitcoin (BTC) at $113,999.23, with a market cap at $2.27 trillion and market dominance of 57.63%. Over 24 hours, BTC increased by 1.02%. Despite a 5.13% drop over 30 days, 90-day data shows a 6.42% rise, fueling discussions around potential shifts. Analysts detail how the Fed’s policies can impact demand.

Insights from Coincu researchers point to lower rates fostering liquidity in crypto markets. Historically, similar events have accelerated the adoption of blockchain technologies, enhancing decentralized finance (DeFi) projects. This context underscores how policy inputs drive attention to digital assets amid traditional economic changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |