- U.S. December non-farm payrolls increased by 50,000, below expectations.

- Crypto prices slightly dipped following the report.

- Expectations for gradual Fed rate cuts remain intact.

The U.S. Bureau of Labor Statistics reported a 50,000 increase in non-farm payrolls for December 2025, falling short of the expected 60,000.

This smaller-than-expected growth, alongside wage increases, suggests a complex economic backdrop impacting both traditional and cryptocurrency markets.

December Payrolls Report Impacts Fed’s Rate Decisions

The U.S. Bureau of Labor Statistics reported a December increase in non-farm payroll jobs by 50,000, below the anticipated 60,000. The unemployment rate changed slightly, remaining stable at 4.4%. The modest shift in payrolls follows a revision of previous figures, indicating a softer-than-expected job increase in recent months. The Federal Reserve’s role in analyzing such data remains substantial, as it considers monetary policy shifts in response to labor market trends.

Immediate implications are diverse, with financial analysts noting potential adjustments in rate expectations. Market reactions indicated a complex picture, with the U.S. dollar showing decreased strength and mixed reactions from equity markets. The slight miss in job growth expectations has also injected subtle volatility into markets, pushing expectations of potential interest rate actions by the Federal Reserve.

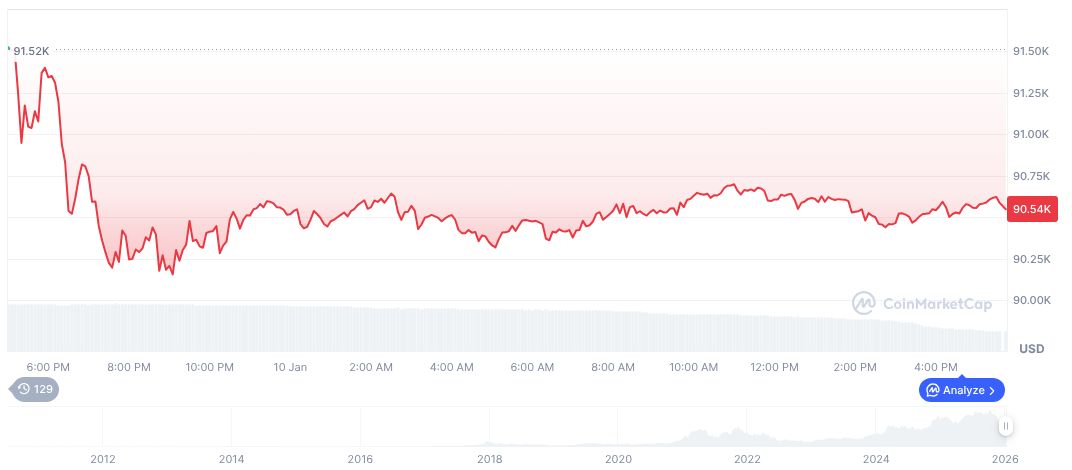

Notable reactions included a general softness in crypto prices. Major cryptocurrencies such as Bitcoin and Ethereum experienced minor declines. The absence of dramatic quotes from major figures in the crypto community underscores the broader influence of macroeconomic trends over specific digital asset responses.

“The US dollar is mostly lower on this as it reacts to the headline and the poor revisions.” – Macro Commentary Source, Institutional Macro Analyst

Bitcoin and Crypto Markets Respond to Payroll Numbers

Did you know? During past soft but not catastrophic payroll reports, Bitcoin often exhibited minor corrections, reflecting macroeconomic correlations rather than causations.

Bitcoin’s current price stands at $90,819.58, as per CoinMarketCap. The market cap reaches $1.81 trillion, maintaining a 58.46% dominance. Recent price changes show a 0.33% increase over 24 hours, slightly balanced against a 0.55% decline over seven days. The 30 to 90-days metrics indicate more pronounced adjustments, with declines of up to 21.15%. This performance snapshot highlights Bitcoin’s price volatility in relation to macroeconomic data.

Insights from the Coincu research team suggest the potential for regulatory adjustments impacting markets in the wake of these job numbers. Historical data usually aligns such payroll reports with expectations of gradual Federal Reserve interventions, which can moderately affect liquidity flows within cryptocurrency markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |