- U.S. stock indices record highs; crypto stocks Crcl, MSTR, COIN vary.

- Nasdaq up 0.81%; Dow, S&P hit records.

- Crypto stocks display mixed performance, reflecting market sentiment.

Major U.S. stock indexes closed higher on January 10, with the Nasdaq, S&P 500, and Dow Jones posting gains, impacting crypto-related stocks like Circle, MicroStrategy, and Coinbase.

This reflects a risk-on sentiment in broader equity markets, indirectly influencing crypto stocks, without new regulatory or on-chain events directly affecting BTC or ETH.

U.S. Stocks Hit Record Highs Amid Optimistic Markets

The Nasdaq climbed 0.81%, while the S&P 500 rose 0.65%. Both indices recorded fresh highs in early January, reflecting optimistic markets. In contrast, CRCL increased by 1.36%, but MSTR and COIN fell 5.77% and 1.96% respectively.

The equity market’s upward movement suggests growing confidence. This shift may pave the way for future strategies by companies indirectly linked to crypto. Current market dynamics highlight a contrast in sector sentiment.

Market reactions underscore an evolving landscape. Michael Saylor, Executive Chairman of MicroStrategy, emphasizes BTC accumulation strategy, shaping MSTR’s responses. He stated, “We see MicroStrategy as a leveraged BTC play when equities are strong.” Nasdaq’s positive trend highlights investor optimism in tech-driven growth.

Crypto Stocks Diverge as Bitcoin Holds Over $90,000

Did you know? The record highs of the S&P 500 and Dow are repeated trends since 2020, often marking periods of increased risk appetite and impacting crypto stocks variably.

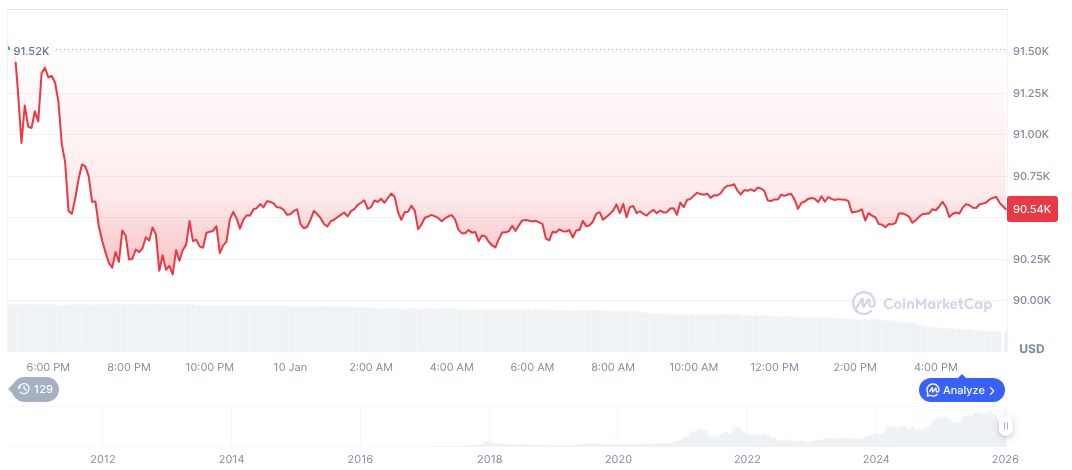

In recent Bitcoin statistics, the price is quoted at $90,508.43 with a market cap of formatNumber(1807833787859.94,2) and a dominance of 58.45%. It has seen recent fluctuations, posting a 24-hour rise of 0.22% and a seven-day increase of 0.47%. Figures come courtesy of CoinMarketCap, January 10, 2026.

Insights from the Coincu research team indicate potential for expansion in regulatory frameworks. Historical data suggest that positive equity movement translates to broader risk appetite in crypto markets, emphasizing a nuanced understanding of market relationships.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |