| Key Points: – Three Arrows Capital (3AC) secures court approval to raise its FTX claim to $1.5B, citing wrongful asset liquidation. – FTX debtors argue the claim expansion disrupts reorganization efforts but fail to provide sufficient evidence. – The ruling marks a major turning point in the 3AC vs. FTX legal battle, impacting ongoing crypto bankruptcy cases. |

Three Arrows Capital (3AC) has won a crucial legal battle, securing approval to expand its FTX claim to $1.5 billion. The ruling challenges FTX’s asset liquidation practices and raises questions about ongoing crypto bankruptcy proceedings.

The decision significantly impacts ongoing bankruptcy claims and could influence future rulings in similar cases involving collapsed crypto firms. Legal experts suggest that this case may shape how creditors assert claims in digital asset bankruptcies.

3AC Gains Court Approval to Expand FTX Claim to $1.5B

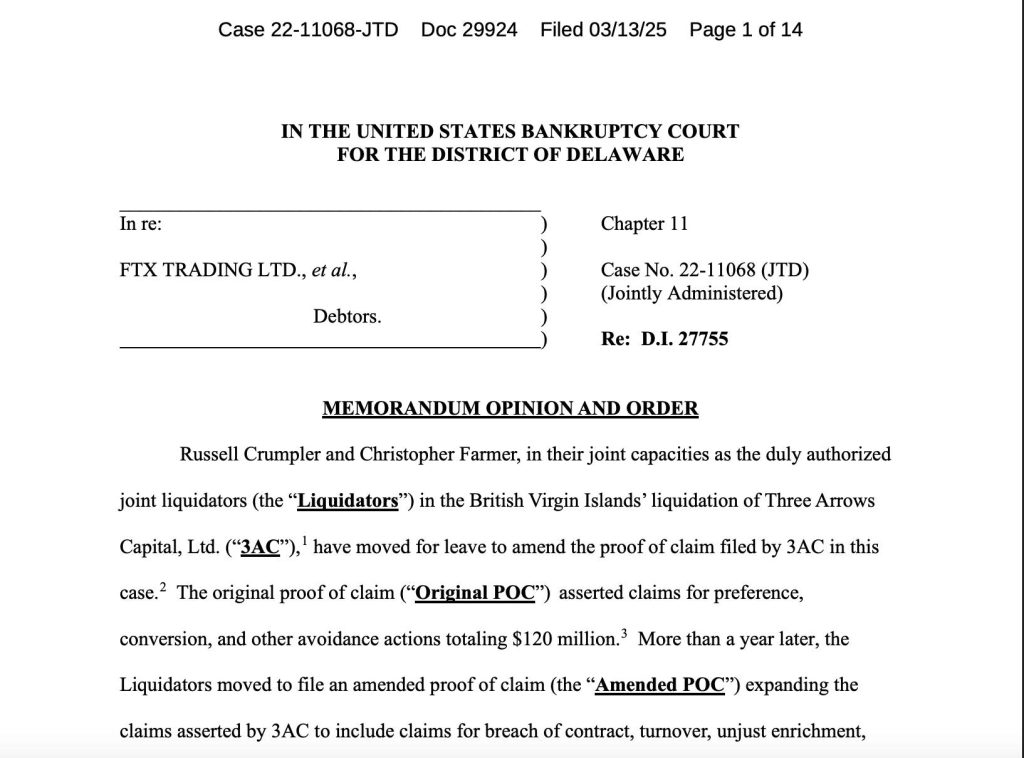

According to “Mbottjer” – the pseudonymous co-founder of FTX Creditor – The U.S. Bankruptcy Court for the District of Delaware has ruled in favor of Three Arrows Capital (3AC), allowing the collapsed hedge fund to expand its claim against FTX from $120 million to $1.5 billion. The decision follows allegations that FTX improperly liquidated 3AC’s assets to cover its debts before its downfall in November 2022.

Judge John Dorsey dismissed FTX’s objections, stating that the delay in filing was primarily due to FTX’s failure to provide crucial financial records. The court affirmed that 3AC’s liquidators had consistently signaled the possibility of increasing their claim and were hindered by FTX’s lack of cooperation.

FTX Challenges Ruling, Citing Risk to Reorganization Plan

FTX’s legal team strongly opposed 3AC’s expanded $1.5 billion claim, arguing that the move introduces significant uncertainty and may delay FTX’s restructuring process. According to FTX, the sudden increase in the claim was unexpected and would complicate creditor repayments.

However, the court found FTX’s argument unconvincing, emphasizing that the exchange had ample notice of 3AC’s intent. The ruling now raises questions about FTX’s financial obligations and how it plans to distribute assets to its creditors.

Crypto Bankruptcy Fallout: What Comes Next?

The legal battle between 3AC and FTX is one of many high-profile disputes emerging from the crypto market collapses of 2022. Three Arrows Capital, once managing over $3 billion in assets, fell apart after the Terra-LUNA implosion, setting off a domino effect that contributed to FTX’s own bankruptcy months later.

Beyond FTX, 3AC is also pursuing a $1.3 billion claim against Terraform Labs, further complicating the ongoing legal battles in the crypto space. Meanwhile, former Binance CEO Changpeng Zhao (CZ) has raised suspicions about FTX’s role in Terra’s collapse, hinting at deeper connections between these major events.

Despite the legal turmoil, FTX’s token (FTT) has surged over 7.2% in the past 24 hours, defying market expectations. As bankruptcy cases continue to unfold, the industry is closely watching how creditors, regulators, and former executives will navigate the next phase of crypto’s legal reckoning.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |